How to Get Loan with Low Credit Score/CIBIL score In 2025

How to Get Loan with Low Credit Score: Loans are what economies, firms, and individuals rely going in times of financial crisis. It is a well-known and straightforward financial aid in which the borrowed amount is returned within a specified time frame with an additional interest amount agreed upon by both parties. However, is it that easy to receive a loan? What is the important factor that will increase your odds of being eligible for it in times of need? These instant loans can be acquired even with a low CIBIL score. The eligibility criteria are very easy for almost anyone.

Get a loan for a low CIBIL score: Learn how?

Let’s dive into it

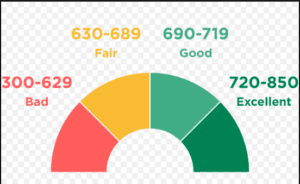

The first and most important factor is your credit score. But what’s a credit score? Simply put, a credit score determines the customer’s value and ability to pay back the amount they borrowed. It can vary between 300 and 850; the better the score, the more lenders trust the borrower.

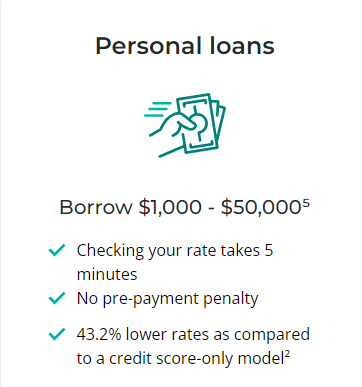

1. Upstart Loans

These instant loans can be acquired even with a low CIBIL score. The eligibility criteria are very easy for almost anyone. The requirement is a 300-credit. It is considered almost impossible to receive loans with such a bad credit score that banks won’t even think twice before rejecting your loan application, but here is an upstart making the impossible possible.

The amount you can receive on these types of loans is

$1000-$50,000 (80,000-4,000,000 Indian rupees)

These loans can be provided for the following purposes:

- House renovation

- refinancing of credit cards,

- Consolidation of debt,

- wedding,

- or medical expenses

The time bracket of these loans is also very feasible for a lot of people, which is 3–5 years with no pre-payment penalty. This period is ample for repayment of a loan, no matter how bad your financial situation is at the moment. Therefore, you don’t even need to think twice before applying for this personal loan if you have a low CIBIL score and you meet the criteria for the debt purposes mentioned above.

2. Simple instant loan apps

Several apps provide loans regularly, but none come close to AVANT’s flexibility in requirements and quality of services.

AVANT is offering $2000-35,000 (160,000-29,000,000 Indian rupees). This type of amount is quite handsome considering that it accepts even a bad credit score and that too over such a reasonable period of 2-5 years, which is more than enough time to recover from whatever setback you are facing and gather the funds to repay the amount. Another advantage of AVANT is that there is no early payoff penalty. If you are unable to pay back the amount on time, you will be granted a 10-day grace period before being charged a $ 25 late payment surcharge for each day you are late.

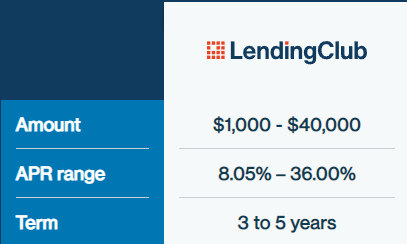

3. Lending Club

Lending Club provides a comprehensive website with a simple application process and a huge loan knowledge center. If getting authorized for a loan is tough due to your credit score, Lending Club enables you to enhance your chances by adding a co-borrower. This option may help you qualify for a loan that you otherwise wouldn’t have been able to, as not all lenders provide it. Most lenders don’t offer you the option of having a co-borrower, but the lending club is an exception.

Lending Club stands out when it comes to offering a wide range of benefits.

It allows joint applications, which aren’t so common in this loan market at these times. It also has a wide range of amount options.

$1,000–50,000 (80,000–4000,000 Indian rupees).

The requirement to receive a loan from a lending club is a minimum credit score of 580, which is fairly low. It also offers you a broad prepayment period of 3–5 years, which many borrowers consider feasible. Considering the bad credit score requirements, what the lending point is offering is very generous, and every borrower should consider it.

Best Indian instant loan apps to get a personal loan with a low CIBIL Score

1. Money Tap

The first credit line, which was an app-based service in India, is called Money Tap. It has a special feature that is simple: you have to pay interest only on the amount that you used out of the loan amount you borrowed. A type of financing, which may be used as a credit card or an instant loan, is offered to users of the personal loan app.

As shown in the picture, it’s simple to apply for a loan. It provides a loan of 3,000- 5 lakh at a monthly interest rate of 1.08%. The repayment period is also very manageable, ranging from 2 to 36 months.

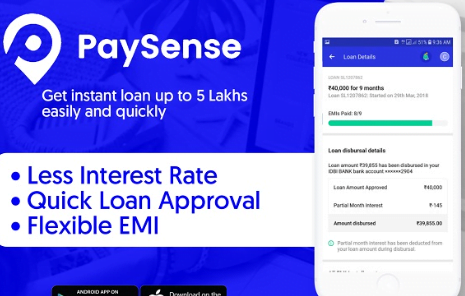

2. Pay Sense

Online instant cash loans are readily available through the instant money app to Pay Sense. You can verify your loan eligibility on a phone or laptop, submit your verified details, and apply for a loan, and you’ll be authorized in about 5 hours. The company can provide the loan at a 1.4–2.3% interest rate. The app has a feature in which you can find out your EMI after putting in the details of the loan you want and other necessary information. A type of sample loan calculation is shown in the figure.

3. Lazy Pay

Pay U serves as the Lazy Pay platform. Finding out if you qualify for a personal loan only requires entering your mobile number! Lazy Pay disburses more than 1 million loans every month thanks to speedy approvals and secure online loan application processing. One of its main products is an immediate personal loan of up to $1,000,000 through a simple digital process with little documentation. Another option is low-interest EMIs. It charges an interest rate of 1.4–2.3% on a repayment period of 90 to 540 days.

4. NIRA

NIRA is a company that provides employed professionals in India with instant loans. You will receive a personal loan in the form of a line of credit with a limit ranging from $3,000 to 1 lakh Indian rupees. The term of the loan varies from 3 to 12 months. It charges an interest rate of 1.67%–2.25%, which is intriguing considering the flexible terms being offered.

5. NAVI

The Navi app is simple to use. They offer loans in India to help you pay for unplanned expenses like medical bills, renting a venue, and so on. This personal loan platform is eager to make financial services transparent and accessible by requiring minimal formal requirements.

Navi can lend up to ₹ 20 lakhs at a 9.9% interest rate (PA).

It offers a prepayment period of up to 6 months. The availability of multiple apps on the market for instant loans makes it easier for Indians to receive loans. In these changing times, these instant loan apps are making it easy for Indians to get loans quickly, even with low credit scores.

Conclusion:

The ways you can get a loan with low CIBIL scores have been discussed in this article. All of them are legitimate ways to borrow money with favorable terms like low-interest rates and a suitable time limit to repay the loan. Receiving loans from apps is very feasible in these times, which is why many people go for them, as not everyone has a good CIBIL score. This has encouraged these apps to operate on a larger scale and make it easier for us to receive loans from them. If you are also looking for a loan with a low CIBIL score, make sure to check out these apps.