The EGG credit card is a unique type of credit card that is designed for individuals who are looking for a simple way to manage their finances. There are several different options available, each with its own set of benefits and drawbacks. In this article, we will take a closer look at the best EGG credit cards and what makes them stand out from the rest.

Capital One Quicksilver Cash Rewards Credit Card: This credit card offers 1.5% cash back on all purchases, with no annual fee or foreign transaction fees. It also provides a one-time $150 cash bonus after spending $500 on purchases within the first three months.

Citi Double Cash Card: This card provides 2% cash back on all purchases, with no annual fee. Cardholders can earn 1% cash back when they make a purchase, and an additional 1% cash back when they pay off those purchases.

Discover it Cash Back: This card offers 5% cash back on rotating categories each quarter, up to the quarterly maximum, and 1% cash back on all other purchases. There is no annual fee and cardholders can receive a match of all the cash back they earn in the first year.

Chase Freedom Unlimited: This card offers 1.5% cash back on all purchases, with no annual fee. It also provides a $200 sign-up bonus after spending $500 in the first three months.

When choosing the best EGG credit card, it is important to consider your spending habits and financial goals. Each of these credit cards has its own unique set of benefits and drawbacks, so it is important to weigh the pros and cons before making a decision. Additionally, it is important to read the terms and conditions of each card carefully before applying, to ensure that you fully understand the fees, rewards, and other features associated with each card.

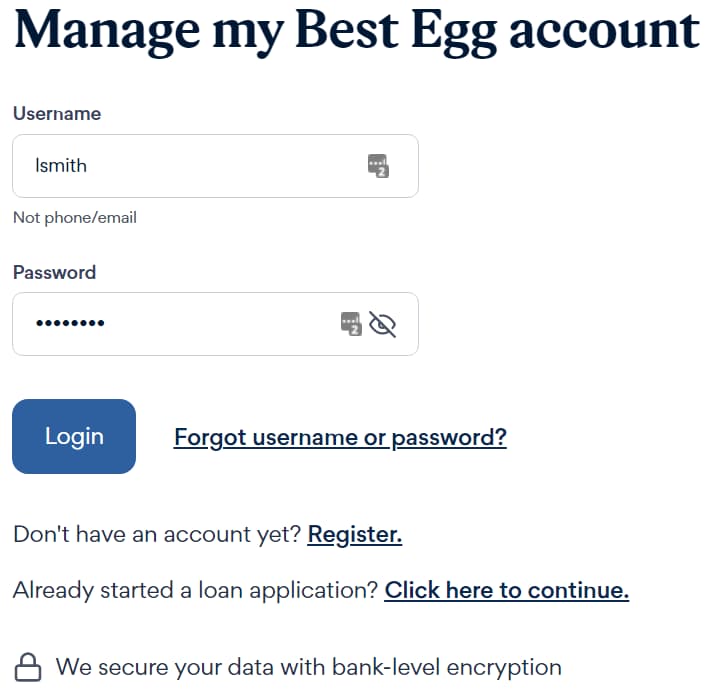

Best EGG credit card login process

To log in to your EGG credit card account, follow these steps:

- Go to the website of the credit card issuer, such as Capital One, Citi, Discover, or Chase.

- Look for a “Sign In” or “My Account” button on the home page and click on it.

- Enter your username and password on the login page. If you don’t have a username and password, you will need to create an account.

- Once you have successfully logged in, you will have access to your account information, including your balance, transactions, and rewards.

- You can also view your statement, make payments, and manage your account settings from the online portal.

It is important to keep your login information secure and to regularly update your password to protect your account from unauthorized access. Additionally, you should be cautious when logging in on public computers or unsecured networks, as this can put your account information at risk.

If you have any problems logging in or need assistance, you can contact the customer service team of your credit card issuer for help. They can assist you with resetting your password, troubleshooting login issues, and more.

Best EGG credit card limit

The best EGG credit card limit depends on your credit score, spending habits, and financial situation. A credit card limit is the maximum amount of credit that a lender is willing to extend to a cardholder, and it is determined by the lender based on a variety of factors.

Here are a few things to keep in mind when it comes to credit card limits:

Credit Score: Your credit score is one of the most important factors that lenders consider when determining your credit card limit. The higher your credit score, the more likely you are to be approved for a higher credit limit.

Income: Lenders also take into account your income when determining your credit card limit. A higher income may indicate that you have more financial stability, which could increase your chances of being approved for a higher credit limit.

Spending Habits: Your spending habits, such as how much you charge to your credit card each month and how often you make payments, can also impact your credit limit. If you have a history of responsible credit card use, you may be more likely to be approved for a higher credit limit.

Other debts: Your current level of debt, including mortgages, car loans, and other credit card balances, can also impact your credit limit. Lenders want to ensure that you are not overextending yourself financially, so a high level of debt may result in a lower credit limit.

It is important to remember that your credit card limit is not set in stone, and it may change over time based on your credit score and other factors. If you are looking to increase your credit limit, you may be able to request a credit limit increase from your lender or apply for a new credit card.

In conclusion, the best EGG credit card limit depends on a variety of factors, including your credit score, income, spending habits, and current level of debt. By understanding how these factors impact your credit limit, you can make informed decisions about how to manage your credit and improve your financial situation.

Best EGG credit card payment process

The payment process for an EGG credit card is generally straightforward and can be done in a few different ways. Here are the most common methods for making a payment on an EGG credit card:

- Online Payment: Most EGG credit card issuers provide an online portal where you can log in and make a payment. Simply log into your account, select the “Payment” option, and enter the amount you want to pay. You will then be able to choose the method of payment, such as a bank transfer or a debit/credit card payment.

- Automatic Payments: You can also set up automatic payments on your EGG credit card, which means that your payment will be made automatically each

How to increase the best EGG credit card limit

Here are some steps you can take to increase your EGG credit card limit:

- Improve Your Credit Score: The better your credit score, the more likely you are to be approved for a higher credit limit. You can improve your credit score by paying your bills on time, reducing your credit card balances, and correcting errors on your credit report.

- Request a Credit Limit Increase: Many EGG credit card issuers allow cardholders to request a credit limit increase online or over the phone. Simply log into your account or call the customer service number on the back of your card and request a higher limit. The issuer will then review your account information and make a decision based on your credit score and other factors.

- Use you’re Card Responsibly: Consistently making on-time payments and responsibly using your credit card can demonstrate to your issuer that you are a trustworthy borrower. Over time, this can increase your chances of being approved for a higher credit limit.

- Consider a New Card: If you have been a responsible borrower but still can’t get a credit limit increase, you may want to consider applying for a new EGG credit card. Some credit card issuers offer higher initial limits to new cardholders, especially those with excellent credit scores.

- Keep Your Credit Card Balances Low: High credit card balances can be a red flag to issuers and may prevent them from increasing your limit. Try to keep your balances low, or pay them off in full each month, to demonstrate your ability to manage credit responsibly.

Remember, the exact process for increasing your EGG credit card limit may vary depending on the issuer, so be sure to check the specific requirements and process with your issuer.

Additionally, increasing your credit limit can have both positive and negative effects on your credit score, so it’s important to carefully consider your financial situation before making a request.

FAQ about the best EGG credit card

How can I apply for the Best Egg Credit Card?

You can start an application anytime online at https://www.bestegg.com/credit-card/.

If you have questions, you can call us at 833-707-1226 to speak with a specialist, but we only accept credit card applications online. We are available to answer any questions during these hours:

Monday – Thursday 8:00 am – 9:00 pm ET

Friday 8:00am – 7:00pm ET

Saturday 9:00am – 6:00pm ET

I pre-qualified for a credit card, does that mean I’m approved?

If you’re pre-qualified or pre-selected, it means that your credit report, as reported by credit agencies, meets certain criteria that we look for in customers. We need additional information, such as income, that you’ll submit in our application to see if you qualify for a credit card.

Just so you know, there’s no impact on your score if we’re unable to approve you for a Best Egg Credit Card.

How can I find out the status of my credit card application?

Typically, you’ll know if you’ve been approved for a Best Egg Credit Card right after submitting your application. In some cases, you may need to send us more information to help us verify your information. In other cases, you might just have to wait a few days for us to review your application. We estimate that you’ll have a final decision within 1-3 business days. What information do you need when I apply for a credit card?

Our application is short and to the point. When you apply for a Best Egg Credit Card, we’ll ask you a few questions regarding your personal information, housing, income, and a few other important details.

What information do you use to see if I qualify for a card?

We consider:

- Information you provide in your credit card application

- Information provided about you by the credit bureaus (including things like your credit score)

- How much money you owe compared to your income (known as your debt to income ratio). This helps us make sure that we offer a credit card that truly helps people make progress in their lives.

What are the requirements to apply for a Best Egg Credit Card?

To apply for a card, you must:

- Be a U.S. citizen currently living in the U.S., or a permanent resident currently living in the U.S.

- Be of legal age to enter a contract for a credit card in the state you reside

- Have a valid email address

- Have a physical address

What if my card payment hasn’t been posted?

If your payment hasn’t been posted, the first thing to check is if your payment was mailed to the correct address:

Card:

Best Egg Credit Card

PO Box 70164

Philadelphia, PA 19176-0164

Card Overnight:

Wells Fargo Lockbox

Best Egg Credit Card

Attn: Box: #70164

400 White Clay Center Drive

Newark, DE 19711

What happens if I miss a payment on my credit card?

If you miss your credit card payment due date, you may be charged a late fee of up to $39. Opting into auto pay is a great way to make sure you never miss a payment and continue to build your credit.

“Please keep in mind that returned payments may result in the cancellation of your automatic payments.”

What happens if I go over my credit line?

Once you go over the limit, you won’t be able to make new charges to your account until you pay down your balance.

You will not be charged an over-limit fee if you go over your limit.

What kind of Visa benefits do I get with my card?

As a Best Egg Credit Cardholder, you’ll be able to take advantage of all Visa® Traditional Credit Card benefits.

How do I view my credit card account activity?

To view your account activity, you’ll need to register your account on BestEgg.com.

To register:

- Click ‘Login’ on the top of your screen and go through the registration process. You’ll need your 16-digit account number.

- Then, you can set your credentials and be able to access your account online anytime.

You can also manage your credit card using the Best Egg Card Mobile App, available on Android and iOS stores. Download it and use the same login information you set up online to log in.

Finally, you can always give us a call at 833-707-1226 anytime to use our automated system or speak with a representative.

How do I find out my credit card payment due date?

Your due date will appear on your Best Egg Credit Card statement, which is sent via email. You can access your digital statement online anytime by logging into your account on BestEgg.com.

You’ll also receive an email reminder close to your upcoming due date.

Does Best Egg have a Mobile App?

Currently, the Best Egg Credit Card has a Mobile App, where users can manage their cards, set payments, view their spending insights, and more. Click here to download the Best Egg Credit Card Mobile App. You’ll need to register your account online at BestEgg.com first, before trying to log in via the Mobile App.

We do not currently have a smartphone app for Best Egg Loan or Financial Health users.

What credit bureaus do you report card payment history to?

We report information about the status of your Best Egg Credit Card to the three main consumer reporting agencies, Experian, Equifax, and Trans Union. This means we may also report late payments, missed payments, or other delinquencies on your account.

If you have a Best Egg Credit Card and you’d like to dispute how it appears on your credit report, you can mail your dispute request to this address:

Best Egg

PO Box 7606

Philadelphia, PA 19101

How do I reset my password?

If you forgot your password, or simply want to update your password, visit us here and click ‘Forgot Username or Password.’

If you go through the process to recover your account and still have issues, shoot them a message at [email protected], or look for the Live Chat feature on the page and let them know what is going on. They are available Monday through Thursday from 9 am – 7 pm, Friday 8 am – 5 pm, and Saturday 9 am – 1 pm ET.

He is the founder and owner of Ventures Money, a leading finance and investment website. With over 10 years of experience in the finance industry, Mustafa is passionate about helping everyday investors make smart decisions with their money.

After getting a lot of experience, Mustafa worked at several top investment banks before deciding to launch this site. His goal was to create an approachable, jargon-free resource for investing advice and market analysis.

Under Mustafa’s leadership, Ventures Money has become one of the most trusted sites for investment strategies, stock research, and personal finance tips. Every day, Mustafa and his team of finance experts work hard to break down complex financial topics into clear, actionable guidance.

When he’s not busy running Ventures Money, Mustafa enjoys spending time with his family, staying active outdoors, and learning about the latest innovations in finance tech. He lives in India with his family including his wife and one child.