What are short-term investments?

Short-term investments are financial assets with a relatively short-term horizon, typically one year or less. These investments aim to provide liquidity, capital preservation, and modest returns over a relatively short period.

The investments are generally considered to be low-risk. They are often used as a means of preserving capital or generating modest returns for short-term goals, such as saving for a down payment on a home or covering unexpected expenses. However, it’s important to keep in mind that all investments come with some degree of risk and it’s crucial to carefully consider individual financial goals, risk tolerance, and investment timeline before choosing a short-term investment.

Read More: Best EGG Credit Card Review 2023

5 Best Types of Investments In 2023

- High-Yield Savings Accounts

- Short-Term Certificates of Deposits

- Short-Term Government Bonds Funds

- Money market funds

- Short-term corporate bonds

1. High-Yield Savings Accounts

High-yield savings accounts (HYSA) are a type of short-term investment plan that offers a modest return on funds deposited in an FDIC-insured savings account. The interest rate offered on HYSA accounts is usually higher than traditional savings accounts, making it a popular option for investors seeking a low-risk investment with easy liquidity.

Some key features of high-yield savings accounts include:

- Low risk: Funds deposited in an FDIC-insured savings account are insured up to $250,000, making it a low-risk investment option.

- Liquidity: High-yield savings accounts offer easy access to funds, with the ability to withdraw money at any time without penalty.

- Convenient: High-yield savings accounts can be easily opened and managed online, making them a convenient investment option for busy investors.

- Modest return: High-yield savings accounts offer a modest return, usually in the range of 1% to 2% per year, making it a suitable investment option for investors seeking a low-risk, low-return investment.

It’s important to note that the interest rate offered on high-yield savings accounts is subject to market conditions and may change over time. It’s also important to regularly monitor the interest rate offered by different banks to ensure that one is earning the highest possible return on investment.

In conclusion, high-yield savings accounts are a popular short-term investment option for those seeking a low-risk, low-return investment with easy liquidity. By choosing a high-yield savings account and regularly monitoring interest rates, investors can earn a modest return on their investment while preserving capital.

2. Short-Term Certificates of Deposits

Short-term certificates of deposit (CDs) are a type of short-term investment plan that offers a fixed rate of return over a specified period. CDs are issued by banks and are FDIC-insured, making them a low-risk investment option.

Some key features of short-term CDs include:

- Fixed-rate of return: Short-term CDs offer a fixed rate of return that is agreed upon at the time of investment, making it an attractive option for investors seeking stability and predictability.

- Low risk: CDs are FDIC-insured, making them a low-risk investment option.

- Fixed investment period: CDs have a fixed investment period, usually ranging from 3 months to 1 year, during which the funds cannot be withdrawn without penalty.

- Modest return: Short-term CDs offer a modest return, usually in the range of 1% to 2% per year, making it a suitable investment option for those seeking a low-risk, low-return investment.

It’s important to note that the interest rate offered on short-term CDs may be lower than other short-term investment options, such as high-yield savings accounts or money market funds. Additionally, the funds invested in a CD cannot be accessed without penalty until the investment period has ended.

In conclusion, short-term CDs are a popular short-term investment option for those seeking a low-risk, fixed-return investment. By choosing a short-term CD, investors can earn a modest return while preserving capital, with the added benefit of a fixed rate of return and FDIC insurance.

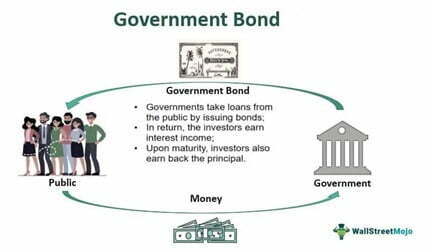

3. Short-Term Government Bonds Funds

Short-term government bond funds are a type of mutual fund that invests in bonds issued by the federal government or government agencies with a maturity of fewer than 3 years. These bonds are considered to be low-risk investments as they are backed by the full faith and credit of the issuing government.

Some key features of short-term government bond funds include:

- Low risk: As the bonds held in a short-term government bond fund are issued by the government, they are considered to be low-risk investments.

- Predictable income: Short-term government bond funds offer a predictable income stream, with regular interest payments made to investors.

- Diversification: By investing in a short-term government bond fund, investors can achieve diversification across multiple bonds, reducing the risk of investing in individual bonds.

- Professional management: Short-term government bond funds are professionally managed, making it a convenient investment option for those without the time or expertise to manage their bond portfolio.

It’s important to note that the return on investment in a short-term government bond fund is generally lower than other types of investments, such as stock mutual funds. Additionally, the fund’s value may fluctuate based on changes in interest rates.

In conclusion, short-term government bond funds are a popular low-risk investment option for those seeking a predictable income stream and the benefits of professional management. By investing in a short-term government bond fund, investors can achieve diversification and preserve capital while earning a modest return on investment.

4. Money market funds

Money market funds are a type of mutual fund that invests in short-term, low-risk debt securities such as government bonds, certificates of deposit, and commercial paper. These funds are designed to provide investors with a low-risk investment option that offers a higher yield than traditional savings accounts.

Some key features of money market funds include:

- Low risk: Money market funds invest in low-risk debt securities, making them a relatively safe investment option.

- High liquidity: Money market funds invest in short-term securities, making them highly liquid and easy to sell if needed.

- Competitive yield: Money market funds typically offer a higher yield than traditional savings accounts, making them a popular option for investors looking for a low-risk investment with a competitive return.

- Professional management: Money market funds are professionally managed, making them a convenient investment option for those without the time or expertise to manage their portfolio.

It’s important to note that while money market funds are considered low-risk, the fund’s value may fluctuate based on changes in the value of the underlying securities. Additionally, the yield on a money market fund is subject to change, and past performance is no guarantee of future results.

In conclusion, money market funds are a popular investment option for those seeking a low-risk investment with a competitive yield. By investing in a money market fund, investors can achieve low risk, high liquidity, competitive yield, and professional management, although past performance is no guarantee of future results.

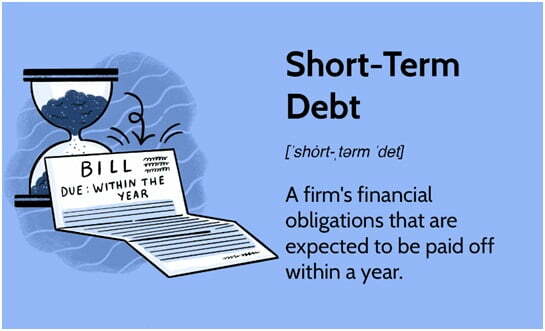

5. Short-term corporate bonds

Short-term corporate bonds are debt securities issued by corporations with a maturity of one to three years. They are considered a type of fixed-income investment, as they provide a predictable stream of income in the form of regular interest payments.

Some key features of short-term corporate bonds include:

- Fixed income: Short-term corporate bonds provide a fixed stream of income in the form of regular interest payments.

- Potential for higher yield: Compared to other short-term investments, such as money market funds or government bonds, short-term corporate bonds may offer a higher yield.

- Professional management: For those who do not have the time or expertise to manage their portfolio, short-term corporate bonds can be purchased through professionally managed bond funds.

- Credit risk: As with all bonds, the creditworthiness of the issuer is a key factor in the safety and stability of the investment. While short-term corporate bonds are generally considered lower risk than longer-term bonds, there is still a risk that the issuer may default on the bond, resulting in a loss of principal.

It’s important to note that the yield and value of short-term corporate bonds may fluctuate based on changes in interest rates, the creditworthiness of the issuer, and other market conditions.

In conclusion, short-term corporate bonds are a popular investment option for those seeking a fixed stream of income and the potential for a higher yield. By investing in short-term corporate bonds, investors can achieve a fixed income, professional management, and the potential for a higher yield, although there is also credit risk involved, and past performance is no guarantee of future results.

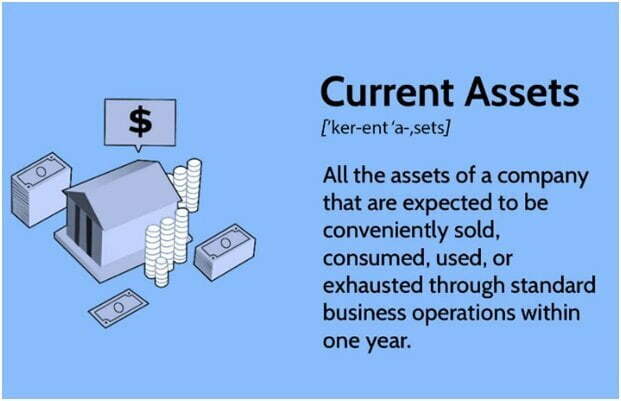

Current assets

Current assets are assets that are expected to be converted into cash or used up within one year or less. They are considered to be the most liquid form of assets, as they can be quickly converted into cash to meet a company’s short-term obligations. Some common examples of current assets include:

- Cash: Physical currency and deposits in checking or savings accounts.

- Short-term investments: Financial instruments such as Treasury bills, commercial paper, and money market funds.

- Accounts Receivable: Amounts owed to the company by its customers for goods or services sold on credit.

- Inventory: Raw materials, work-in-progress, and finished goods that are held for sale.

- Prepaid expenses: Amounts paid for expenses that have not yet been incurred.

- Marketable securities: Securities that can be easily sold in the financial markets, such as stocks and bonds.

These assets are important for a company’s liquidity and solvency, as they provide a source of immediate funding for the company’s operations and obligations. In financial analysis, a company’s current assets are compared to its current liabilities to determine its ability to meet short-term obligations and maintain positive cash flow.

Short-term investment stock

Short-term investment in stocks can be a high-risk, high-reward option for those looking for quick gains. However, due to the volatility of the stock market, there is also a greater risk of losing money in the short term. Some of the best short-term investment options in stocks include:

- Blue-chip stocks: Large, well-established companies with a history of stable growth and a strong financial position, such as Microsoft, Apple, or Johnson & Johnson.

- Dividend-paying stocks: Companies that pay regular dividends to shareholders, providing a steady stream of income even in volatile market conditions.

- Technology stocks: Companies in the technology sector, such as software and internet companies, that have the potential for significant growth in a short period.

- Penny stocks: Stocks with a low market capitalization that trade for less than $5 per share, offering the potential for quick gains but also carrying a higher risk level.

It’s important to keep in mind that stock prices can be affected by a variety of factors, including economic conditions, company performance, and market sentiment, and there is no guarantee of returns in the short term. It’s always recommended to thoroughly research a company and its financial position before investing in its stock and to consult with a financial advisor if necessary.

Read More: Adriana’s Insurance Services: Providing Comprehensive Coverage for Peace of Mind 2023

Short-term investment plan with a high return in India

In India, there are several short-term investment options with the potential for high returns, although they come with varying levels of risk. Some of the best short-term investment options include:

- Fixed Deposits (FDs): A low-risk option with a fixed interest rate for a specified period, offered by banks and non-banking financial companies (NBFCs).

- Liquid Funds: A type of mutual fund that invests in highly liquid, short-term debt securities, such as government bonds and commercial papers. They offer a higher return compared to savings accounts and are considered a low-risk option.

- Short-term bonds: Debt securities issued by companies or the government with maturities of less than 3 years, offering a higher return compared to FDs, but with a slightly higher level of risk.

- Equity-linked savings schemes (ELSS): A type of mutual fund that invests in equities and has a lock-in period of 3 years, offering the potential for higher returns over the short-term, but with a higher level of risk.

It’s important to keep in mind that the return on investment can be affected by various factors, such as interest rates, market conditions, and the creditworthiness of the issuer. It’s always recommended to consult with a financial advisor before making any investment decisions and to diversify one’s investment portfolio to spread risk and maximize returns.

Short-term investment plan for 1 month

| Investment Option | Return | Risk | Liquidity |

| High-yield savings accounts | Low to moderate | Low | High |

| Short-term government bonds | Guaranteed | Low | Moderate |

| Money market funds | Moderate | Low | High |

Here’s a comparison of the key features of some popular short-term investment options for a one-month investment horizon:

Note: Returns and risks are subject to market conditions and may vary over time. It’s important to consult with a financial advisor before making any investment decisions.

Short-term investment plan for 3 months

| Investment Option | Return | Risk | Liquidity |

| High-yield savings accounts | Low to moderate | Low | High |

| Short-term bonds | Moderate to high | Moderate | Moderate |

| Money market funds | Moderate | Low | High |

| Certificates of deposit (CDs) | Moderate to high | Low | Low |

Here’s a comparison of the key features of some popular short-term investment options for a three-month investment horizon:

Note: Returns and risks are subject to market conditions and may vary over time. It’s important to consult with a financial advisor before making any investment decisions and to consider one’s personal financial goals and risk tolerance when choosing an investment option.

Short-term investment plan for 6 months

Here’s a comparison of the key features of some popular short-term investment options for a six-month investment horizon:

| Investment Option | Return | Risk | Liquidity |

| High-yield savings accounts | Low to moderate | Low | High |

| Short-term bonds | Moderate to high | Moderate | Moderate |

| Money market funds | Moderate | Low | High |

| Certificates of deposit (CDs) | Moderate to high | Low | Low |

| Treasury bills (T-bills) | Guaranteed | Low | High |

Note: Returns and risks are subject to market conditions and may vary over time. It’s important to consult with a financial advisor before making any investment decisions and to consider one’s personal financial goals and risk tolerance when choosing an investment option.

FAQ of short-term investment plan

Here are some frequently asked questions (FAQs) about short-term investment plans:

What is a short-term investment plan?

A short-term investment plan is a type of investment that is intended to be held for a short period, usually less than 3 years. The primary objective of short-term investments is to preserve capital while earning a modest return.

What are some popular short-term investment options?

Popular short-term investment options include high-yield savings accounts, short-term bonds, money market funds, certificates of deposit (CDs), and treasury bills (T-bills).

What are the benefits of a short-term investment plan?

The benefits of a short-term investment plan include preservation of capital, low risk, and ease of liquidation. Additionally, short-term investment plans offer the flexibility to adjust investment portfolios as market conditions change.

What are the risks associated with short-term investment plans?

While short-term investment plans are considered low-risk compared to long-term investments, they still come with some level of risk. The risks associated with short-term investment plans include interest rate risk, credit risk, and market risk.

Is it necessary to consult a financial advisor before making a short-term investment?

It’s always recommended to consult with a financial advisor before making any investment decisions, including short-term investments. A financial advisor can help assess one’s financial goals and risk tolerance, and recommend the best investment options that align with those factors.

Can short-term investment plans be used to achieve long-term financial goals?

While short-term investment plans are intended for a short investment horizon, they can still play a role in achieving long-term financial goals. By investing in a diversified portfolio of short-term investments, one can accumulate a substantial amount of savings over time.

Note: The information provided in this FAQ is for informational purposes only and does not constitute investment advice. It’s important to consult with a financial advisor before making any investment decisions.

Read More: Robert Kiyosaki Net Worth 2023: How he Made his Money?

Conclusion

In conclusion, short-term investment plans can offer a low-risk option for investors seeking to preserve capital and earn a modest return over a short period. There are several popular short-term investment options available, each with its own unique set of benefits and risks. Before making any investment decisions, it’s important to consult with a financial advisor and to consider one’s personal financial goals and risk tolerance. By taking these steps, investors can choose the best short-term investment plan to meet their financial needs and help them achieve their long-term financial goals.