Adriana’s Insurance Service is a reputable business that offers a wide variety of insurance options. The organization has been around for quite some time, and throughout that time it has established a solid reputation for providing its clients with reliable protection. Adriana’s Insurance provides many types of coverage, including vehicle, home, health, life, and business insurance. As a firm, we are dedicated to making sure our clients have access to the insurance policies they require to safeguard their assets and secure their financial futures.

Adriana’s Insurance provides a variety of services, but car insurance is particularly well-liked. Vehicles as diverse as cars, trucks, motorbikes, and recreational vehicles are all covered by the firm’s policies. An uninsured motorist policy, a collision policy, a comprehensive policy, and a liability policy are just some possibilities available to policyholders. Customers can save money on their insurance premiums with Adriana’s Insurance thanks to the company’s many discounts for safe drivers, multiple vehicles, and other considerations.

Adriana’s Insurance also provides vital home coverage through its home insurance policy. Houses, condos, and rental properties, as well as contents and liability, are all covered by the firm’s policies. Homeowners and renters may safeguard their properties from perils like fire, theft, and natural disasters by selecting from a choice of coverage options. Additional peace of mind can be purchased from Adriana’s Insurance in the form of coverage for jewels, artwork, and collectibles.

Adriana’s Insurance recognizes the importance of health insurance and provides a wide variety of plans to satisfy the diverse demands of its clientele. The company provides a range of health insurance plans for individuals and groups, each with its own set of benefits, deductibles, and co-pays. Policyholders can get the care they need when they need it from anyone in a pre-established network of top-notch medical professionals. Adriana’s Insurance is devoted to serving the needs of its clients by providing comprehensive health insurance at competitive rates.

Adriana’s Insurance provides several critical services, including life insurance. Depending on their needs, policyholders can select from the company’s range of term life, whole life, or universal life insurance policies. Policyholders can rest easy knowing that their loved ones will be provided for financially in the case of their untimely demise thanks to the protection provided by life insurance. Life insurance policies are available from Adriana’s Insurance for individuals, families, and corporations.

You may like – Is aeymd.com a Legitimate website or a Scam?

Adriana’s Insurance understands the importance of meeting the diverse demands of its commercial clientele by providing a wide array of insurance policies. To aid businesses in protecting their assets and maintaining financial security, the firm offers a variety of insurance policies, including liability, property, and workers’ compensation coverage. Adriana’s Insurance takes the time to learn about each business and its individual needs to design comprehensive policies that cover everything from lawsuits to natural disasters.

Who owns Adriana’s insurance?

Adriana’s Insurance owner

Besides leading The Rise Academy, Adriana Gallardo also runs her own insurance company, Adriana’s Insurance. She is a successful entrepreneur who moved from Mexico to the United States at a young age to make it big in the world of business and sales. Adriana’s Insurance was the result of her hard work and dedication despite the obstacles she faced as a woman in the insurance industry. She is a successful entrepreneur and businesswoman, and she appeared on the show “Rica, Famosa, and Latina.”

Since she had such a positive experience, she felt compelled to tell her story to encourage other women and members of the Latino community. To achieve this goal, Adriana Gallardo decided to develop the show “Life in Heels,” on which she reveals her true self as a woman with emotions, a mother, and a successful businesswoman. Following her divorce, Adriana shows us how she rebuilds her life, falls in love again, launches a successful business, and educates her staff to succeed. She serves as the “Life in Heels” compass and main character.

Adriana Insurance’s net worth

- Adriana Gallardo is a Mexico-born businesswoman who has a net worth of $10 million

- Adriana Insurance is a fictional insurance company, so it does not have an actual net worth. As a fictional entity, any details about its finances are imaginary.

- For a fictional insurance company like Adriana Insurance, its net worth would depend on factors like how long it has been in business, the types of insurance products it sells, its customer base, its investment portfolio, real estate holdings, etc.

- As a hypothetical example, if Adriana Insurance was portrayed as a large, established national insurer, its net worth could plausibly be in the billions of dollars. This would reflect substantial assets like premium and investment income, real estate, financial reserves to pay out claims, etc.

- On the other hand, if Adriana Insurance was a smaller regional or local insurer, its net worth would likely be much lower, perhaps in the millions or tens of millions.

- Overall, without specific details from the fictional source material about Adriana Insurance’s size, history, and financial performance, its net worth can only be estimated very generally. The company’s net worth would be shaped by storytelling needs rather than precise financial calculations.

Does this help provide some context regarding the fictional net worth of the imaginary insurance company Adriana Insurance? Let me know if you need any clarification or have additional questions!

Adriana’s insurance services

Adriana’s Insurance is an insurance company that provides extensive policy choices to its clients. All sorts of insurance policies are on sale from the firm.

1. Auto Insurance: Adriana’s Insurance provides coverage for a range of vehicles, including cars, trucks, motorcycles, and RVs. Policyholders can choose from a variety of coverage options, such as liability, collision, comprehensive, and uninsured motorist coverage.

2. Home Insurance: Adriana’s Insurance offers coverage for homes, condos, and rental properties, as well as for personal possessions and liability. Policyholders can choose from a range of coverage options to protect their homes and belongings against risks such as fire, theft, and weather-related damages.

3. Health Insurance: Adriana’s Insurance provides both individual and group health insurance policies, with a range of coverage options, deductibles, and copayments. Policyholders have access to a network of quality healthcare providers.

4. Life Insurance: Adriana’s Insurance offers term life insurance, whole life insurance, and universal life insurance, allowing policyholders to choose the coverage that best meets their needs. Life insurance provides financial protection for policyholders’ loved ones in the event of their death.

5. Business Insurance: Adriana’s Insurance provides coverage for businesses, including liability insurance, property insurance, workers’ compensation insurance, and more. The company works with its business customers to understand their unique needs and provide customized coverage.

Adriana’s Insurance is committed to providing its customers with quality coverage options and personalized service. The company’s goal is to provide peace of mind to its policyholders, knowing they are properly protected.

Adriana’s Insurance online payment

Step 1– From the homepage (), select “payment” from the top navigation (as outlined in the screenshot posted below).

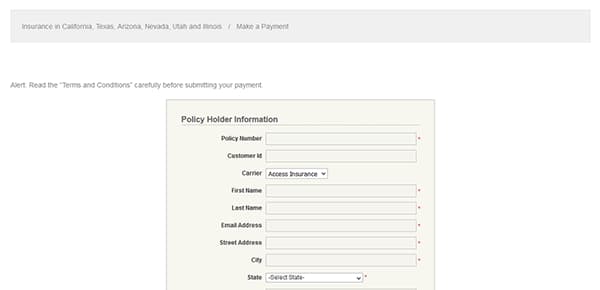

Step 2 – Enter the following details into the form:

Policy number

Customer ID

Carrier (select from the drop-down list)

First name

Last name

Email address

Street address

City

State

ZIP code

Phone number

Credit card (select from the list)

Payment amount

Full name of the account holder

Credit card number

Expiration date

Verification number (found on the back of the card)

Address, city, state, ZIP (billing address)

Step 3 – Agree to the terms/conditions and then press the submit button to complete your payment.

File a Claim

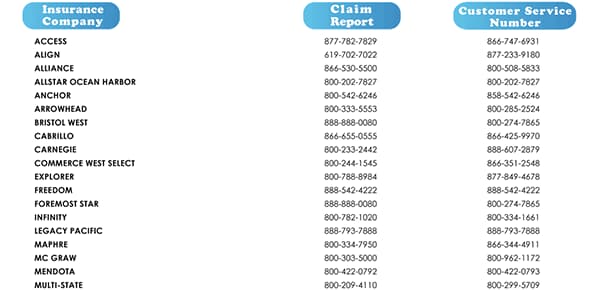

Step 1 – Go to the main claim reporting page here.

Step 2 – Scroll down the page until you see the contact details of your carrier.

Note: You may be able to report a claim on your carrier’s website.

Adriana’s Insurance Phone Number

He is the founder and owner of Ventures Money, a leading finance and investment website. With over 10 years of experience in the finance industry, Mustafa is passionate about helping everyday investors make smart decisions with their money.

After getting a lot of experience, Mustafa worked at several top investment banks before deciding to launch this site. His goal was to create an approachable, jargon-free resource for investing advice and market analysis.

Under Mustafa’s leadership, Ventures Money has become one of the most trusted sites for investment strategies, stock research, and personal finance tips. Every day, Mustafa and his team of finance experts work hard to break down complex financial topics into clear, actionable guidance.

When he’s not busy running Ventures Money, Mustafa enjoys spending time with his family, staying active outdoors, and learning about the latest innovations in finance tech. He lives in India with his family including his wife and one child.