Robert Kiyosaki wrote the book Rich Dad’s Guide to Investing, which gives readers a smart way to look at investing. The book “Rich Dad Poor Dad” by Robert Kiyosaki made him a network marketer and household name as a financial educator, speaker, and author.

The book gives practical advice and plans that can help people become financially independent and free. In this article, we’ll talk about the most important parts of the book and what you should take away from it.

There are four parts to the book. Kiyosaki talks about why people should invest in Part 1. He talks about how important it is to learn about money and how investing isn’t just about making money but also about getting smarter about money. He says that the best way to become financially free is to put money into stocks, bonds, and real estate.

In Part Two, Kiyosaki talks about the most important ideas about investing. He talks a lot about how important it is to know the difference between assets and liabilities and how important cash flow is. He also talks about the risks and benefits of different kinds of investments, such as stocks, bonds, mutual funds, and real estate.

Part Three is all about more advanced ways to invest. Kiyosaki talks about how important it is to understand the market cycles and how to use them to your advantage. He also talks about how important it is to invest in businesses and how entrepreneurs play a role in that. Kiyosaki also talks about “paper assets” like options and futures, as well as the risks that go along with them.

In the last part, Part Four, Kiyosaki tells you how to start investing in a real way. He talks about how to get over the fear of investing and how important it is to take action. He also advises on how to look at investments and decide what to do with them.

Some Key takeaways Point

One of the most important things to learn from Rich Dad’s Guide to Investing is how important it is to learn about money. Kiyosaki says it’s important to learn about money, which means knowing the difference between assets and liabilities and how important cash flow is. He says that investing isn’t just a way to make money, but also a way to learn about money.

Another important thing to learn from the book is that you need to act. Kiyosaki says that investing is not a spectator sport and that the best way to learn is by doing. He tells people to start small and build up their investments slowly over time.

How many pages are in Rich Dad’s guide investing?

Rich Dad’s Guide to Investing has different numbers of pages depending on the edition and format. But the book’s first edition, which came out in 2000, has 403 pages. It’s important to remember that some newer editions may have more information or updates, which could change the total number of pages.

Final Thoughts of Robert Kiyosaki

A friend of Robert’s once tried to save money for the college education of his four children. But only $12,000 was there. It was obvious that it wouldn’t happen soon. Even though the market was down, he told his friend to buy a house in Phoenix. After two weeks, they found a nice house with three bedrooms and two bathrooms. The owner wanted to sell. Even though the owner wanted $102,000, they bought the house for $79,000.

His friend needed $7,900 for a down payment. After all the bills were paid, his friend had $125 left over each month. He thought he would live there for 12 years. He put his $125 towards the mortgage to pay it off faster. Someone gave him $156,000 for the house three years later. Robert told him to use a 1031 tax-deferred exchange to sell it. Then he bought a small storage unit.

After three months, he was making $1,000 a month, which he put into the college fund. A few years later, he sold that small warehouse for close to $330,000. The money from his next investment, which gave him $3,000 a month, went back into the college fund. The man is now sure that he will be able to pay for college for his children. All of this began with just $7,900.

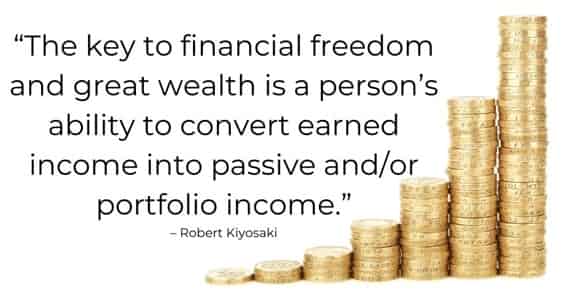

There are three ways to make money:

- Normal Earned

- Passive

- Portfolio

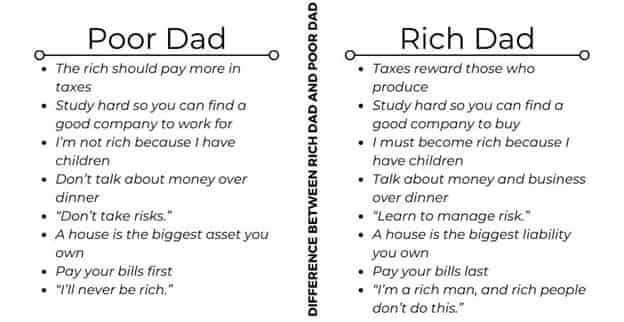

Poor dad: You don’t make much, get a safe job.

Rich Dad: Make your money work for you with a portfolio and passive income.

“A person’s ability to turn earned income into passive and/or portfolio income is the key to financial freedom and great wealth.”

“Risk is when you don’t know what you’re doing,” says Warren Buffett.

Rich dad would often say, “If you want to be rich, you need to know what kind of income to work hard for, how to keep it, and how to protect it from loss. That is the key to making a lot of money… If you don’t know the differences between these three types of income and don’t learn how to get and keep them, you’ll probably spend your whole life making less money than you could and working harder than you should.

How you spend your money and time will shape your future. The future of your family will depend on the choices you make today.

Conclusion

In conclusion, Rich Dad’s Guide to Investing is a great book for anyone who wants to learn more about investing. The book covers a wide range of topics, from basic rules to advanced strategies, and gives practical advice on how to get started. The author stresses how important it is to learn about money, take action, and understand the different kinds of investments. This makes the book good for both new investors and those who have been investing for a while. By reading the book, readers can learn more about money, make better decisions, and work towards financial independence and freedom.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.