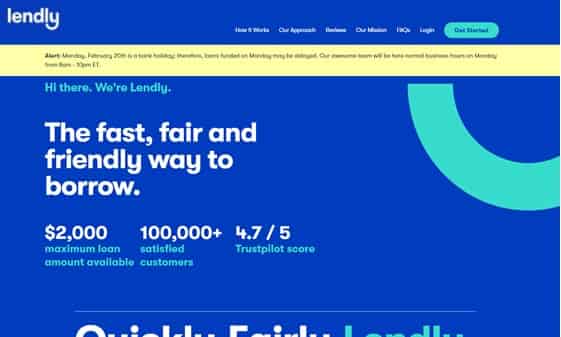

Lendly Loan: Lendly is a financial services company that helps people with different credit histories get personal loans. Since it started in 2017, Lendly has become known for its easy application process, low rates, and great customer service. In this article, we’ll look at Lendly’s loans and services based on customer reviews and other relevant information.

With more than 25 years of experience in the consumer lending business, the people who started Lendly saw firsthand how many people couldn’t get loans that were affordable and had fair rates and terms.

Millions of adults who work hard can’t get credit cards or loans with fair terms. Because of this, the Lendly loan was made to give people a loan with non-traditional ways of approving it and an easy and affordable way to pay it back.

Application Process

The application procedure on Lendly is simple and quick. Online loan applications let consumers apply while protecting their privacy. Lendly uses this data to ascertain the customer’s loan eligibility and provide competitive rates. Approval decisions for loans are communicated to borrowers within a few hours of their application, and this has been corroborated by testimonials from satisfied borrowers.

Read More: 8 Effortless ways to get loan with low credit scores/CIBIL score In 2023

Lendly loan login process

Lendly is an online lender that offers personal loans to individuals. If you have applied for a loan with Lendly and have been approved, you will need to create an account and log in to manage your loan. In this article, we will provide you with a step-by-step guide on how to log in to your Lendly account.

Step 1: Visit the Lendly website the first step is to visit the Lendly website at www.lendly.com.

Step 2: Click on the “Login” button on the top right corner of the Lendly homepage, and click on the “Login” button.

Step 3: Enter your email and password Enter the email address and password you used when you created your Lendly account.

Step 4: Click on the “Login” button Click on the “Login” button to access your account.

Step 5. If you have forgotten your password, click the “Forgot Password” link on the login page, and follow the instructions to reset your password.

Once you have logged into your Lendly account, you can manage your loan, view your payment schedule, make payments, and access other account information. Lendly also offers a mobile app that you can use to manage your loan on the go. You can download the app from the App Store or Google Play Store.

Lendly loan requirements

Lendly is a reputable company that gives people personal loans. If you’re thinking about getting a personal loan through Lendly, it’s important to know what the loan requirements are so you can see if you meet them. In this article, we’ll explain what you need to do to get a Lendly loan.

- Requirements for Age and Where to Live

To get a Lendly loan, you have to be at least 18 years old and live in the United States permanently.

- Income Requirements

Borrowers on Lendly must have a steady source of income to repay their loan. The minimum annual income needed is $20,000.

- Score for credit

Lendly looks at a borrower’s creditworthiness based on several factors, such as their credit history and how much debt they have compared to their income. Even though Lendly doesn’t say what the minimum credit score is, a higher credit score will likely lead to lower interest rates and better loan terms.

- Direct Deposit and Bank Account

To get a Lendly loan, you must have a checking account that is open and can accept direct deposits. This lets Lendly send the loan money straight to your bank account and set up automatic loan payments.

- Valid Identification

To prove who you are, you will need to show a valid government-issued ID, like a driver’s license or passport.

It’s important to remember that just because you meet these basic requirements doesn’t mean you’ll get a loan. Lendly will look at your loan application and how good your credit is to decide if you can get a loan and what terms you can get. In the approval process, other things like employment history and the reason for the loan may also be looked at.

Also Read: What Is a Development Loan? A Comprehensive Guide 2023

Loans like lendly

If you’re thinking about getting a personal loan and want options like Lendly, you might want to look at a few other lenders. Here are some other places to get personal loans that are similar to Lendly in terms of features and requirements:

- SoFi

SoFi is a company that gives out low-interest personal loans with no fees. SoFi is a lot like Lendly in that you can apply for a loan online quickly and easily, and the money can be sent to you in just a few business days. SoFi also sells and provides other financial products and services, such as refinancing student loans and managing wealth.

- Best Egg

Best Egg is an online lender that gives out personal loans with competitive interest rates and different ways to pay them back. Like Lendly, Best Egg lets you apply online quickly and easily, and the money can be sent to you in a few business days. Best Egg also has debt consolidation loans and services to keep an eye on your credit.

- Upstart

Upstart is a lender that gives out personal loans to people who have little or no credit history. Upstart is similar to Lendly in that you can apply for a loan online quickly and easily, and the money can be sent to you in a few business days. Upstart also uses algorithms based on artificial intelligence and machine learning to decide who to lend money to and how much.

- Avant

Avant is an online lender that helps people with fair to good credit get personal loans. Like Lendly, Avant lets you apply for a loan online, and the money can be sent to you within one business day. Avant also has debt consolidation loans and resources to help people improve their credit.

To find the loan that fits your needs and budget the best, you should compare rates, fees, and repayment terms from different lenders. Before you take out a personal loan, make sure you understand the terms and conditions, such as the interest rate, when you have to pay it back, and if there are any fees or penalties.

The number for lendly and Customer Care

You can get in touch with Lendly’s customer service team by phone or email. Here are Lendly’s customer service phone number and email address:

Phone Number:

The number to call for help with Lendly is 1-844-611-6734. From Monday to Friday, from 9 a.m. to 6 p.m. Eastern Time, you can call them.

Emailing Customer Service:

You can also send an email to support@lendly.com to talk to Lendly’s customer service team. Most of the time, they answer emails within 24 hours.

The customer service team at Lendly can help with a wide range of questions, such as loan applications, payments, account management, and general customer service. If you need help or have a question, don’t hesitate to call or email Lendly’s customer service team.

Here are some questions that people often ask about Lendly:

What does Lendly do?

Lendly is an online company that helps people get personal loans. Most loans from Lendly are unsecured, which means that you don’t have to put anything up as security.

What are the amounts and terms of the loans?

Lendly lets you borrow between $1,000 and $35,000. You can pay back the loan over 24 to 60 months.

What are the fees and interest rates?

The interest rates on Lendly vary based on your credit score and other things. The rates of interest are between 5.99% and 35.99%. Lendly does not charge any fees for applying or for paying off the loan early.

What do you have to do to be eligible?

To be eligible for a Lendly loan, you must be at least 18 years old, a U.S. citizen or permanent resident, make at least $20,000 a year, and have a valid bank account and government-issued ID.

How do I use Lendly to get a loan?

On their website, you can fill out an application for a loan from Lendly. The application process is quick and easy, and you can get a loan decision within minutes.

How long does it take to get money back from a loan?

If you are approved for a loan, you can get the money as soon as the next business day.

How do I pay back my loan from Lendly?

You can set up automatic payments from your bank account through Lendly’s automatic payment options. You can also use the Lendly website or mobile app to make payments by hand.

Can I pay my loan back early?

Yes, you can pay off your Lendly loan early without paying a fee.

Is Lendly a good place to borrow money?

Lendly has a good reputation as a lender, and both customers and experts in the field have said nice things about it. The Better Business Bureau has approved Lendly and given it an A+ rating.

What do I do if something goes wrong with my Lendly loan?

If you are having trouble with your Lendly loan or account, you can call or email their customer service team for help.

Conclusion

Lendly is an online lender that gives out personal loans with flexible terms for paying them back and low-interest rates. Their loans are unsecured, which means you don’t have to put anything up as security to get money from them. Lendly’s online application process is quick and easy, and if you are approved, you can get your loan money as soon as the next business day.

The customer service team at Lendly is available to answer any questions or concerns you may have. They also offer automatic payment options to make it easy to pay back your loan. Overall, Lendly is a reputable lender that makes it easy and convenient for people to get a personal loan. But it’s important to look over the loan terms and conditions carefully and make sure that the loan fits into your budget and helps you reach your financial goals.