Indian college students and young professionals can get short-term loans through the mobile app mPokket. The app makes it easy and quick for people who don’t have a long credit history or a strong financial profile to get credit.

With the mPokket app, users can apply for loans from Rs. 500 to Rs. 20,000, which can be sent to their bank account within minutes. The app has a simple, easy-to-use interface, and the loan application process doesn’t require much paperwork.

At first, a student’s credit limit is low, but as he builds up a credit history, that limit goes up. Well, mPokket doesn’t just give loans to students; it also gives loans to individuals with careers. This was a summary of the mPokket company.

Is mPokket app real or fake?

Yes, the mpokket app is a real mobile app that Indian college students and young professionals can use to get short-term loans. Thousands of people have downloaded and used the app, and there are several reviews on app stores and other sites.

But it’s important to be careful when using any mobile app and to learn more about it before you download and use it. Make sure to check who made the app, read reviews from more than one source, and only download from trusted app stores like Google Play Store or Apple App Store.

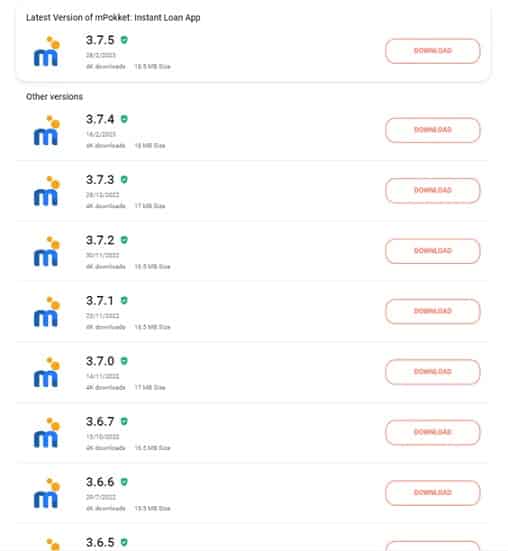

mPokket app download new and old version

Interest rate

The interest rate that mpokket app charges for short-term loans depend on things like the loan amount, how long it is for, and how good the borrower’s credit is. Most of the time, the interest rate is between 1% and 1.5% per day.

Even though short-term loans can be helpful, it’s important to know that they often have higher interest rates than traditional loans. Before you apply for a loan, you should carefully look at your finances and make sure you will be able to pay it back.

Depending on the loan agreement, mpokket may also charge processing fees, late payment fees, or other fees. Before you agree to the loan, make sure you’ve read and understood the terms and conditions.

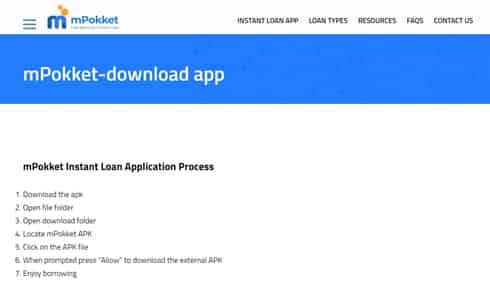

mPokket Instant Loan Application Process

- Download the apk

- Open file folder

- Open download folder

- Locate mPokket APK

- Click on the APK file

- When prompted press “Allow” to download the external APK

- Enjoy borrowing

Follow these steps to put the mpokket app on your phone:

- Open the Google Play Store on your Android phone or tablet or the App Store on your iOS device.

- Type “mpokket” into the search bar and click “search.”

- The mpokket app should come up when you search. Just click it.

- Click the “Install” button to get the app on your device and install it.

- Once the app is installed, you can open it and make an account by entering your information and sending the required documents.

- Once your account has been verified, you can use the app to apply for a loan and keep track of it.

Note: Before you download and install the app, make sure your device meets the app’s system requirements. Also, it’s important to only get the app from reliable places, like the official app store, to avoid getting fake or harmful apps.

Here’s what you need to run the mpokket app:

For Android devices:

- Android 5.0 (Lollipop) or a later version

- RAM of at least 2 GB

- At least 150 MB of free space for storage

- Connecting to the Internet (Wi-Fi or mobile data)

For Apple iOS:

- After iOS version 10.0

- RAM of at least 2 GB

- At least 150 MB of free space for storage

- Connecting to the Internet (Wi-Fi or mobile data)

To make sure the app runs smoothly and you can use all of its features, it’s important to make sure your device meets the system requirements.

Operational Cities

mpokket app is currently operational in many cities across India. The list of operational cities may vary from time to time, and it’s best to check the app or website for the latest updates.

The mpokket app was available in the following cities in India:

- Delhi/NCR

- Mumbai

- Pune

- Bangalore

- Hyderabad

- Chennai

- Kolkata

- Ahmedabad

- Jaipur

- Chandigarh

- Lucknow

- Surat

- Vadodara

- Bhopal

- Indore

- Ranchi

- Patna

- Guwahati

- Jamshedpur

- Allahabad

- Varanasi

- Dehradun

Again, it’s important to check the app or website for the latest updates on the list of operational cities.

Loan types

Indian college students and young professionals can get short-term loans through the mpokket app. The app lets you borrow money for things like school, travel, medical emergencies, or other personal costs.

The types of loans that mpokket app offers are:

Personal loans: These loans are for your own needs and can be used for things like buying a smartphone, paying bills, etc.

Education loans: These loans are made just for college students and can be used to pay for tuition, books, and other education-related costs.

Travel loans: You can use these loans to pay for things like plane tickets, hotel reservations, and other travel-related costs.

Medical loans: You can use these loans to pay for things like hospital bills, diagnostic tests, and other medical costs.

The loan amount and length can change based on the type of loan and other factors, like the borrower’s creditworthiness and history of making payments. Before you agree to the loan, make sure you’ve read and understood the terms and conditions.

Loan requirements

To get a loan from the mpokket app, the borrower must meet certain criteria, which may include:

Age: The borrower must be an Indian citizen and at least 18 years old.

Employment status: The borrower must be a college student or a young professional with a steady source of income.

KYC documents: The borrower must show valid KYC documents, such as an Aadhaar card, PAN card, or college ID card.

Bank account: To get the loan money, the borrower must have a working bank account.

Creditworthiness: The borrower’s creditworthiness will be judged based on their financial history, credit score, and how well they have paid back loans in the past.

Here are some resources related to mpokket app:

mpokket website: The official website of mpokket app provides information about the app’s features, loan types, eligibility criteria, and other details. The website can be accessed at https://mpokket.com/.

mpokket app: The mpokket app can be downloaded from the Google Play Store or Apple App Store. The app allows users to apply for loans, track their loan application status, and manage their loan accounts.

Customer support: mpokket provides customer support through email and phone. Users can reach out to the customer support team for any queries or issues related to the app or loans.

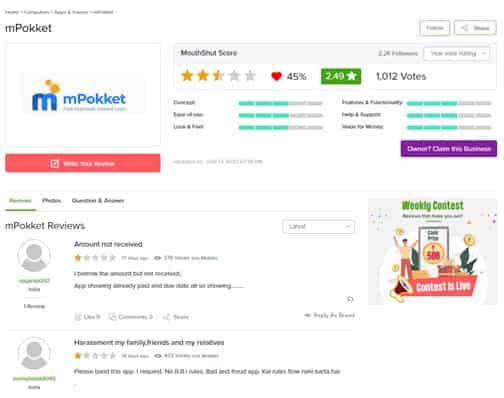

Reviews: There are several reviews available on app stores and other platforms that provide insights into the user experience and the app’s features. However, it’s important to be aware of fake reviews and only relies on genuine reviews from trusted sources.

Social media: mpokket app has a social media presence on platforms such as Facebook and Twitter, where users can get updates and engage with the brand.

It’s important to carefully evaluate the information from various sources and read and understand the terms and conditions of the loan agreement before applying for a loan from mpokket app.

Reviews about mpokket

FAQs

How much is the most a college student who works full-time can borrow?

One of the best loan apps in India for college students is mPokket. It lets college students borrow up to Rs 30,000.

How can an 18-year-old get a small loan?

We give college students an instant loan as long as they can show proof that they are enrolled in college and have their KYC documents on hand. If you are a young professional, you will have to send in your KYC documents along with your payslips from the last 3 months.

How can I borrow money while I’m in college?

One of the best college loan apps in India, mPokket, gives college students an instant loan as long as they have proof of admission (like a mark sheet, college ID, letter of admission, etc.) and their KYC documents.

Conclusion

In India, the mpokket app is a mobile lending platform that lets college students and young professionals get loans right away. Users can apply for a loan through the app on their phones and have the money sent directly to their bank accounts within minutes, as long as they meet the requirements and send in the necessary documents. The app has a user-friendly interface and a variety of ways to pay back loans.

This makes it convenient and easy to use. But it’s important to note that before applying for a loan, borrowers should carefully read and understand the loan agreement, including the interest rates, fees, and repayment schedules. Borrowers should also make sure they have enough money to pay back the loan on time to avoid penalties or damage to their credit scores. Overall, the mpokket app can be a good choice for people who need money quickly.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.