The Banter Credit Card is a rewards credit card from JPMorgan Chase. It is made to give cashback rewards on different types of buying. People who use credit cards like this card because it has flexible bonus categories doesn’t have an annual fee and has other perks. In this piece, we’ll look at the Banter Credit Card and what it has to offer.

Some silent extra features of Banter Credit Card

- Paybacks in Cash

The cashback points program is one of the most important parts of the Banter Credit Card. Cardholders can get cash back on a variety of purchases, such as eating out, traveling, and going to the movies. The card gives you 3% cash back on the area you choose from a list, and 1% cash back on everything else you buy. Cardholders can change the group they choose every three months. This lets people get more cashback on the areas where they spend the most.

- Signup Bonus

New users can also get a bonus when they sign up for the Banter Credit Card. Users must spend a certain amount in the first few months after starting an account to get the bonus. This bonus can be turned in for a credit on your bill or cash that is put into your bank account.

- No Fee per Year

The fact that there is no annual fee is another big plus of the Banter Credit Card. This means that users can get cash back without having to pay an annual fee to use the card.

- Even more benefits

The Banter Credit Card has a rewards program and doesn’t charge an annual fee. It also has a few other perks. For example, the card comes with several travels and buy protections, such as insurance for trip cancellation and interruption, insurance for delayed baggage, and protection for purchases. Through the card’s partnerships with entertainment venues and ticketing companies, cardholders can also get entry to special events and experiences.

- Things to think about

There are many good things about the Banter Credit Card, but there are also some possible bad things. For example, the card’s cash-back rebates are only available on certain types of purchases, which might not work for everyone. The APR on the card can also be pretty high, especially for people with less-than-perfect credit. Cardholders should also be aware of any fees that come with the card, such as fees for transferring a sum or getting a cash advance.

- Banter Credit Card’s Special Offer Plan

For the 6 and 12-month credit plans, if you don’t pay off the full amount by the end of the promotional time, interest will be added to your account.

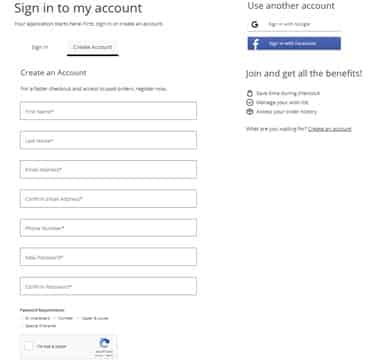

How to log in for Banter Credit Card

Follow these steps to sign in to your Banter Credit Card account:

- Go to https://www.comenity.net/bantercard/, which is the website for the Banter Credit Card.

- Click “Sign In,” which is at the top of the page.

- In the spaces given, type in your username and password.

- To sign in to your account, click the “Sign In” button.

Once you’ve signed up for online access and logged in to your account, you can see how much money is in your account, make payments, look at your transaction records, and more.

The pros and cons of the Banter Credit Card:

| Pros | Cons |

| Cashback rewards on all eligible purchases | High APR |

| No annual fee | Limited rewards categories |

| Welcome bonus | Foreign transaction fee |

| Introductory 0% APR | Limited redemption options |

| Digital tools to manage your account | |

| Security features such as fraud protection and zero liability protection |

I hope this table helps to provide a clearer picture of the advantages and disadvantages of the Banter Credit Card.

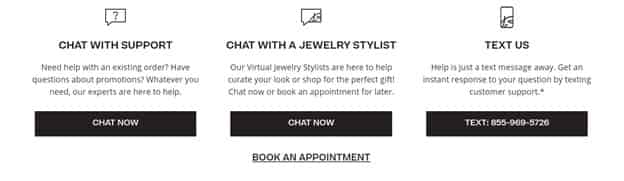

Customer service and phone number of Banter Credit Card

Customer service for Banter Credit Card is very good. If you ever have questions or opinions about your order or shopping experience, they love to hear from you.

Text and chat:

Monday through Friday, from 8 am to 12 am ETSaturday10 AM — 10 PM ETSunday12 PM — 9 PM ET

Appointments:

Monday through Friday, from 9 am to 10 pm Saturday: 12 PM — 10 PM Sunday: 12 PM — 9 PM ET

Frequently Asked Questions

Can I use my credit card from Banter at Zales?

JPMorgan Chase, one of the biggest credit card companies in the United States, gives out the Banter Credit Card. Because of this, the card is widely accepted at many places that take credit cards, like Zales.

Zales is a famous jewelry store that sells a wide variety of diamond and gemstone jewelry, watches, and other accessories. You should be able to use your Banter Credit Card at Zales as long as the store accepts credit card payments.

But before making a purchase, it’s always a good idea to check with the store to make sure they accept your credit card. Also, make sure your Banter Credit Card has enough available credit to cover the cost of your buy as well as any interest charges or fees that may apply.

Is Banter Credit Card issued by Comenity Bank?

Yes, Banter Credit Card Accounts are issued by Comenity Capital Bank.

What is Comenity?

Comenity is the bank behind your credit card and is here to help make your experience even better. Comenity works with hundreds of well-known and well-liked companies to give their customers, like you, credit programs that connect loyal shoppers to the brands they love.

What is banter’s return policy?

Banter is happy to offer returns that are free and easy. If you are unhappy with your purchase for any reason, you can return it within 30 days of the date it was shipped for a full refund of the purchase price, minus any shipping, handling, or other fees. You can change your order up to 90 days after the date it was shipped.

How long does it take for a refund to be processed?

Returns are handled in 10–14 business days, and refunds are usually given in 5–7 business days after returns are handled.

What’s the difference between normal and expedited shipping?

Standard shipping usually takes between 3 and 7 working days and is free when you spend $50 or more. Also, for an extra fee, you can give expedited shipping in 2 days and express shipping in 1 day. Keep in mind that shipping times start once your package has been processed and has left the delivery center.

Can I get a Banter credit card even if I don’t live in the U.S.?

To apply for a Banter Credit Card account, you must be of legal age in your state or region and have a U.S. mailing address, such as a street, rural route, or APO/FPO (we can’t accept P.O. Box addresses). To apply in person, you must show a legal photo ID from the government. Both in-store and online applications need a legal Taxpayer Identification Number, like an SSN or SIN, that was given by the government.

When will I know if my application is approved?

When you apply online, you will receive an immediate response on the status of your application.

Conclusion

The Banter Credit Card is a rewards credit card that gives cash back on all purchases that qualify, with higher rewards rates in certain areas like dining out and streaming services. The card also has a welcome bonus, no annual fee, and a 0% introductory APR for the first 15 months on purchases and debt transfers.

But the Banter Credit Card also has some possible downsides, such as a variable APR that can be pretty high, limited ways to redeem rewards, and a fee for transactions made in a foreign country.

Overall, the Banter Credit Card may be a good choice for people who don’t want to pay an annual fee and want to get cash back on their daily spending. But people who travel abroad a lot or want more ways to use their rewards may want to look into other options. Before you apply, you should carefully look over the card’s terms and conditions and think about your financial situation, just like you would with any other financial product.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.