Credit Karma Alternatives

Credit Karma is a financial business that provides customers with free access to their credit scores, credit reports, and credit monitoring services. Company founders and employees have called San Francisco, California home since the business’ inception in 2007. By giving customers access to their credit information, educational tools, and tailored recommendations for credit products like credit cards and loans, Credit Karma strives to empower its users to make smart financial choices.

Credit Karma provides its consumers with a wide variety of financial tools and resources, including tax preparation services and a free credit monitoring service, to better manage their money. Credit Karma’s income comes from its agreements with banks and advertising, and it doesn’t charge users a dime.

Alternatives to Credit Karma

Credit Karma alternatives are other companies or services that offer similar features to Credit Karma. Credit Karma is a personal finance company that gives its users free credit scores, credit reports, and credit monitoring services. Some people may choose to use alternatives to Credit Karma if they want a different user interface, and better features, or want to get their credit information from more than one place. There are many alternatives to Credit Karma, such as NerdWallet, WalletHub, Credit Sesame, and others. Each of these services has its unique features and services.

Here are 10 Credit Karma alternatives to check in 2023:

- NerdWallet: NerdWallet is a personal finance website that offers a range of resources, including credit scores, credit monitoring, and credit card recommendations.

- Credit Sesame: Credit Sesame offers a free credit monitoring service that includes access to your credit score, credit report, and credit alerts.

- WalletHub: WalletHub offers a variety of tools, including credit score monitoring, personalized credit card recommendations, and credit improvement advice.

- com: Credit.com provides a free credit report and score, along with personalized credit recommendations and resources for improving your credit.

- Mint: Mint is a personal finance app that allows you to track your spending, budget, and credit score in one place.

- Experian: Experian offers a range of credit monitoring and identity theft protection services, as well as credit reports and scores.

- TransUnion: TransUnion offers credit monitoring and identity theft protection services, as well as credit reports and scores.

- Equifax: Equifax offers credit monitoring and identity theft protection services, as well as credit reports and scores.

- Quizzle: Quizzle offers a free credit report and score, as well as personalized credit recommendations and financial resources.

- LendingTree: LendingTree is a loan comparison website that offers credit monitoring, credit scores, and personalized loan recommendations.

To log in to your Credit Karma account, you can follow these steps:

- Go to the Credit Karma website (www.creditkarma.com) using a web browser on your computer or mobile device.

- Click on the “Log In” button in the top right corner of the homepage.

- Enter the email address and password associated with your Credit Karma account, then click “Log In”.

- If you have two-factor authentication enabled, you will be prompted to enter a code sent to your phone or email address before being allowed to access your account.

If you have forgotten your password, you can click on the “Forgot password?” link on the login page and follow the prompts to reset it. If you are having trouble logging in, you can also contact Credit Karma customer support for assistance.

Credit Karma Security Error

If you are receiving a security error when trying to access Credit Karma, it could be due to several reasons. Here are some steps you can take to troubleshoot the issue:

- Check your internet connection: A weak or unstable internet connection can cause security errors. Make sure your device is connected to a stable network and try accessing Credit Karma again.

- Clear your browser cache and cookies: Clearing your browser’s cache and cookies can help resolve security errors. Go to your browser’s settings and clear your cache and cookies, then try accessing Credit Karma again.

- Check your browser and security settings: Make sure that your browser is up to date and that you have not inadvertently changed any security settings that could be blocking access to Credit Karma.

- Disable any browser extensions: Browser extensions can sometimes interfere with website security. Try disabling any extensions you have installed and then try accessing Credit Karma again.

- Contact Credit Karma customer support: If you continue to experience security errors, you can contact Credit Karma customer support for assistance. They can help troubleshoot the issue and provide guidance on how to resolve it.

Credit Karma Customer Service

Credit Karma provides customer service through its online help center and support page. Here’s how you can access Credit Karma customer service:

- Go to Credit Karma’s website (www.creditkarma.com) and click on the “Help” link at the bottom of the page.

- In the Help Center, you can search for articles related to your question or issue. If you cannot find the information you need, you can click on the “Contact Us” button at the bottom of the page.

- This will take you to the Credit Karma support page, where you can select the category that best describes your issue. You will then be presented with a list of articles related to that topic.

- If you still cannot find a solution, you can click on the “Get in touch” button and submit a support request. You will be asked to provide your name, email address, and a brief description of your issue.

- Once you submit your request, Credit Karma’s customer service team will review it and respond as soon as possible. They typically respond within 1-2 business days.

Alternatively, you can also contact Credit Karma customer service through their social media channels or by phone. The phone number for customer support is typically available in your account settings or on your account dashboard.

Credit Karma Not Working in India

Credit Karma is not currently available in India. The company primarily operates in the United States, Canada, and the United Kingdom, and its services are designed to cater to the credit reporting systems and regulations in those countries.

If you are located in India and are looking for a similar service, there are other credit reporting agencies and personal finance companies that operate in India. Some examples include:

- CIBIL: CIBIL is India’s first credit information bureau and provides credit reports and scores to individuals and businesses.

- Experian: Experian is a global credit reporting agency that also operates in India and provides credit reports and scores to individuals and businesses.

- Equifax: Equifax is another global credit reporting agency that provides credit reports and scores to individuals and businesses in India.

- BankBazaar: BankBazaar is a personal finance company that operates in India and offers a range of financial products and services, including credit reports and scores.

It’s important to note that each of these companies may have different credit reporting systems and regulations, so it’s important to research and choose the one that best fits your needs and situation.

Sure, here is a table summarizing the pros and cons of using Credit Karma:

| Pros | Cons |

| Free credit monitoring | Limited credit report information |

| Free credit scores and reports | Advertisements |

| Personalized financial recommendations | Limited credit monitoring |

| Educational resources | Limited customer support |

It’s worth noting that what may be considered a pro or con for one person may not be the same for another. Therefore, it’s important to assess your personal needs and preferences when considering whether Credit Karma is the right service for you.

The Credit Karma free mobile app’s features

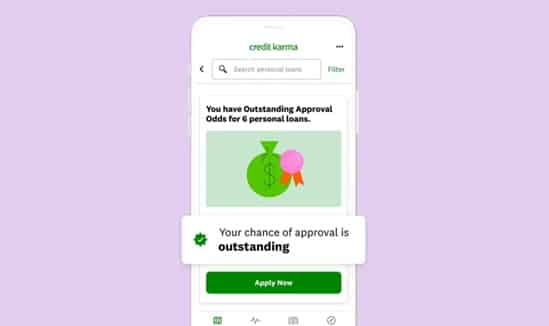

- Personalized approval odds

Before applying for a personal loan or credit card, users of Karma Confidence can look at personalized offers and find out their chances of getting approved. Credit Karma figures out your chances of getting approved by comparing your credit profile to those of other Credit Karma account holders who have been approved by lenders in the past.

- Relief roadmap

During hard times, there is a new tool that helps people find relief programs, resources, and financial services. Once you tell the app about yourself, like how much money your family makes and if you have a job, it will show you information about government stimulus programs, unemployment benefits, relief opportunities, and different loan options.

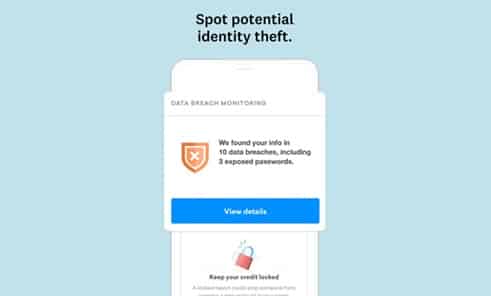

- Free ID monitoring

With a Credit Karma account, you can choose free ID monitoring, which gives you free reports that can help you spot possible identity theft and gives you tips on how to keep your personal information safe. The app might let you know if any of your passwords are out in the open, so you can take the steps you need to secure your account.

- Credit Karma money

The Credit Karma app provides its users with a debit card reimbursement program called Instant Karma and a bank account feature called Early Payday. Credit Karma Cash has two features, dubbed Spend and Save. The rebates on purchases are instantaneous.

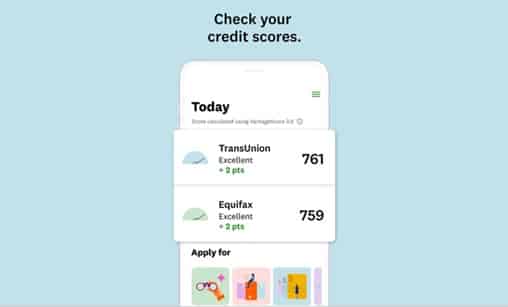

- Check Credit Karma credit score

The ability to check one’s Credit Karma business credit score is the most popular function of the program. Users can get a deeper understanding of credit scores, the factors that go into determining credit, and the steps they can take to improve their ratings via credit review.

- Karma Drive

Credit Karma’s mobile app provides a spin-the-wheel approach to tax deductions. With the app’s drive function, you can keep tabs on your safe driving score and eventually get access to more affordable auto insurance premiums. To get the best rates on auto insurance from a reputable national company, it helps to have a solid driving record.

- Explore different credit cards

Credit card options such as refinancing, shopping, rewards, cash back, debt transfers, and more may be available to you depending on your individual credit history. Credit Karma customers have a 66% better probability of being approved for credit thanks to Karma Confidence technology.

Sure, here are some frequently asked questions (FAQs) about Credit Karma:

Q: Is Credit Karma free?

A: Yes, Credit Karma is free to use. They generate revenue through partnerships with financial institutions and advertisers, but users do not have to pay to access their credit scores, reports, or other services.

Q: Is Credit Karma safe?

A: Credit Karma takes several security measures to protect user information, such as encrypting data and monitoring for potential security breaches. However, no online platform can guarantee 100% security, and it’s always a good idea to take additional steps to protect your personal information.

Is Credit Karma spam?

No, Credit Karma is not spam. It is a legitimate company that provides free credit scores, credit reports, and other financial services to its users. While it does generate revenue through partnerships with financial institutions and advertisers, it does not engage in spamming or other deceptive practices. Credit Karma has a good reputation in the industry and has received positive reviews from millions of satisfied users. However, it’s always a good idea to be cautious when sharing personal information online and to take steps to protect yourself against spam and other types of online fraud.

What country owns Credit Karma?

Credit Karma was founded in the United States in 2007, and it is currently owned by Intuit Inc., a financial software company based in California. Intuit acquired Credit Karma in 2020 for a reported $7.1 billion. While Credit Karma’s services are primarily geared towards the US market, the company has expanded to offer some services in Canada and the United Kingdom as well.

Is a Credit Karma account worth it?

Whether a Credit Karma account is worth it depends on your individual needs and preferences. Here are some factors to consider:

- Access to free credit scores and reports: Credit Karma offers free access to your credit scores and reports from two of the major credit bureaus. If you’re looking to monitor your credit or improve your credit score, this can be a useful tool.

- Personalized financial recommendations: Credit Karma also offers personalized financial recommendations based on your credit profile and financial goals. These recommendations can help you make informed decisions about managing your finances.

- Advertisements: As a free service, Credit Karma generates revenue through partnerships with financial institutions and advertisers. This means that you may see targeted ads while using the platform.

- Limited credit report information: Credit Karma only provides credit reports from two of the three major credit bureaus, so you may not be getting a complete picture of your credit.

Overall, if you’re looking for a free and convenient way to monitor your credit and receive personalized financial recommendations, a Credit Karma account may be worth it. However, it’s important to evaluate whether Credit Karma is the best fit for your specific needs and preferences and to be aware of its limitations.

Q: Does Credit Karma affect my credit score?

A: No, checking your credit score or reports through Credit Karma will not affect your credit score. This is because Credit Karma uses a soft inquiry, which does not impact your credit score.

Q: How often does Credit Karma update my credit score?

A: Credit Karma updates your credit score every week. However, keep in mind that not all creditors report to the credit bureaus on a regular schedule, so changes to your credit report may not show up immediately.

Q: What is a good credit score?

A: Credit scores can range from 300 to 850, and what is considered a “good” score can vary depending on the lender and the type of credit you are applying for. Generally, scores above 700 are considered good, while scores above 800 are considered excellent. You can still get a loan with a low credit score or a low CIBIL score.

Q: Can I use Credit Karma to file my taxes?

A: Yes, Credit Karma offers a free tax preparation service, which can help you file your federal and state taxes online. However, this service may not be available in all states or for all types of tax filings.

Q: How do I cancel my Credit Karma account?

A: To cancel your Credit Karma account, log in to your account and go to the “Settings” page. From there, click on “My profile” and then select “Close my account.” Follow the prompts to confirm the closure of your account.

Conclusion

In conclusion, Credit Karma is a free online service that provides users with access to their credit scores and reports, as well as personalized financial recommendations and educational resources. While there are some limitations to the service, such as the fact that it only provides credit reports from two of the major credit bureaus, it can be a useful tool for those looking to monitor their credit and improve their financial well-being.

However, as with any online platform, it’s important to take steps to protect your personal information and to evaluate whether Credit Karma is the best fit for your specific needs and preferences.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.