Legendary Pine Credit Card Review 2026

The Legendary Pines credit card has been gaining popularity in recent years as an attractive rewards card option. With no annual fee, generous rewards on dining, groceries, and gas, and a competitive sign-up bonus, it’s easy to see the appeal. But is the Legendary Pines card the best choice for your wallet? This in-depth review will examine the pros and cons to help you decide if it’s a good fit.

About the Issuer

Comenity Legendary Pine: Comenity Legendary Pine appears to refer to a credit card issued by Comenity Bank. It seems to be a retail credit card that can be used at Legendary Pine, which I assume is some kind of retail store or company. The card likely offers benefits and rewards to customers of Legendary Pine when they use the card for purchases.

As a store-branded credit card, it may offer discounted financing, exclusive offers, rewards points, and other incentives to encourage customers to shop at Legendary Pine. However, without more details on the specific rewards program, interest rates, fees, and other terms and conditions of the card, I cannot provide a more detailed overview in paragraph form. Please let me know if you have any additional information you can share about Comenity Legendary Pine so I can expand on this summary.

Legendary Financial: The Legendary Pines card is issued by Legendary Financial, a major player in the credit card rewards sphere. Founded in 2005 and based in Wilmington, Delaware, Legendary Financial issues several different rewards credit cards targeted at consumers looking to earn points, miles, and cash back. The company has excellent customer service ratings and a reputation for reliable reward redemption processes.

Pros of the Legendary Pines Credit Card

Here are some of the main benefits of the Legendary Pines credit card:

- No Annual Fee: There is no annual fee to hold the card, which makes it easy to keep long-term. This is becoming rarer among rewards cards today.

- Strong Welcome Offer: New cardholders can earn 50,000 bonus points after spending $3,000 in purchases within the first 3 months. This is equal to $500 in statement credits.

- 3x Points on Dining & Groceries: Earn triple points (equal to 3% back) at restaurants, cafes, coffee shops, and grocery stores. No caps on earnings.

- 2x Points on Gas Stations: All gas station purchases also earn 2x points per $1 spent.

- 1x Points on All Other Purchases: Even non-bonus category purchases earn unlimited 1 point per $1 spent.

- Points Can Be Redeemed for Cash Back: Unlike some travel rewards cards, Legendary Pines points can be redeemed for straight cash back with no limitations. Each point is worth 1 cent.

Cons of the Legendary Pines Card

The Legendary Pines card does come with a few limitations to be aware of:

- No Sign-Up Bonus for Existing Cardholders: Unfortunately,y there is no way to earn the 50,000 point bonus if you already have the card. It is only for new applicants.

- 3% Foreign Transaction Fee: Purchases made outside the U.S. will incur a 3% fee, so it’s not the best card for international travelers.

- No 0% APR Intro Period: This card doesn’t offer a 0% intro APR period for purchases or balance transfers. You’ll pay interest from the start.

- Points Expire After 5 Years of No Activity: Be sure to earn or redeem points at least once every 5 years, or they will expire.

Who Should Consider the Legendary Pines Credit Card?

The Legendary Pines card makes the most sense for certain types of consumers:

- Dining spenders: With no cap on 3x points earned at restaurants, cafes, coffee shops, and more, this card is a strong pick for those who dine out frequently.

- Grocery shoppers: Earning an unlimited 3x points at all grocery stores is very competitive. Good for families or those who spend a lot on groceries.

- Road trippers: The 2x bonus at gas stations can add up quickly for those who drive often. It beats many other gas station rewards.

- Straight cash back fans: If you prefer cash instead of travel rewards, Legendary Pines makes it easy with 1 cent per point redemptions.

- Existing Legendary Financial customers: There are benefits to having multiple accounts with the same issuer, like easier point pooling.

How Does the Legendary Pines Card Compare to Alternatives?

The Legendary Pines card stacks up well against some other popular options:

- Vs Chase Sapphire Preferred: Both have similar signup bonuses and dining rewards. But the Sapphire has a $95 annual fee, earns points on travel, and focuses on flexible transfer points instead of cash back.

- Vs Citi Double Cash: The Double Cash earns 2% back (1% when you buy, 1% when you pay it off) on everything. No bonus categories to keep track of. But the Legendary Pines bonuses on dining and groceries can exceed 2% back.

- Vs Capital One SavorOne: Also no annual fee, with 3% back on dining, groceries, streaming services, and more. But a lower signup bonus and no gas station rewards.

- Vs Blue Cash Preferred from American Express: Strong 6% cash back at U.S. supermarkets (capped at $6,000 per year, then 1%). But it has a $95 annual fee, while the Legendary Pines grocery benefit has no cap.

Should You Get the Legendary Pines Credit Card?

The Legendary Pines card offers a straightforward cash-back rewards program, with strong bonuses on popular spending categories like dining, groceries, and gas. For those who spend heavily in these areas, it can be a great addition to your wallet. Just keep in mind the foreign transaction fees, lack of 0% intro APR, and points expiration policy. Overall, it’s worth considering, especially if you frequently dine out, shop at grocery stores, or hit the road often. Analyze your spending patterns to determine if the unlimited 3-2-1 bonuses line up with how you use your credit card.

How to Apply for the Legendary Pines Credit Card

Ready to apply? Here are quick steps for getting started:

- Go to the Legendary Pines application page and click “Apply Now.

- Provide some basic personal information like your name, address, birth date, and Social Security Number.

- Review details like the credit limit, APR, fees, and terms & conditions. Then click submit.

- If approved, you should receive your new card within 7-10 business days. Activate it and start spending to earn your signup bonus and points on purchases.

As with any credit card, remember to only spend what you can afford to pay back each month. Pay your statement balance in full and on time to avoid interest charges. Follow these responsible practices and enjoy earning cash-back rewards with your new Legendary Pines card!

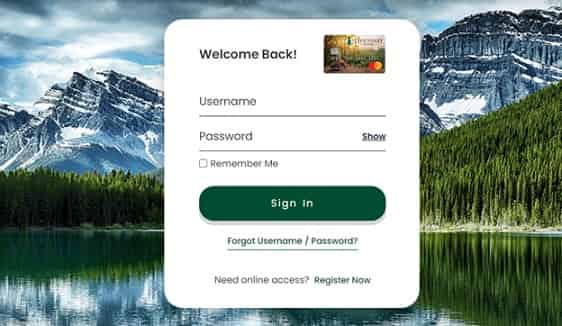

Looking for ways to log in to your Legendary Pine credit card account? You are where you need to be. Customers can get unique access to their accounts 24 hours a day, 7 days a week through the Legendary Pine Credit Card login. With the Legendary Pine Card login, you can pay bills, check your balance, and do a lot more.

Comenity Bank, a banking institution, issues credit cards under the brand name “Legendary Pine” for use as an electronic payment method. Prepaid, charge, and credit cards are all among the types of cards that the business issues and processes. People all over the globe, from private individuals to multinational corporations, can purchase Legendary Pine greeting cards online.

How to Login Legendary Pine Credit Card

By following the steps below, customers can also easily get to their Legendary Pine login page.

- Visit the Legendary Pine Card Login page: https://comenity.net/legendarypine.

- Type in your username and password.

- After that, click the “Login” button to get to your Legendary Pine Card user dashboard.

How to Get Your User ID and Password for Your Legendary Pine Credit Card

On the Legendary Pine Card login page, if you have lost or forgotten your Card User ID or password, it is easy to get them back. To do this, just follow the steps below:

- Go to the login page for the Legendary Pine Card.

- Click on Forgot User ID or Forgot Password.

- Give the information from your Legendary Pine Card to get your user ID back or to change your password.

How to Use the Mobile App to Activate the Legendary Pine Credit Card

The Legendary Pine app can be downloaded from the App Store or the Google Play Store. Check out the advice given below:

- Sign in to the Legendary Pine app on your mobile device.

- Choose Handle cards from the main menu.

- Choose the card that needs to be activated.

- Click on “Activate Card.” If you have more than one card that needs to be activated, choose the one you want to use and click Continue.

- Enter the information from your card and the last four numbers of your Social Security number, and then click “Activate.”

You can pay with your Legendary Pine credit card with a mobile app

You can also pay your Legendary Pine credit card bill with the Comenity app, which is available on both the Play Store and the App Store. Where to get it:

- Android: play.google.com/store/apps/

- iOS: apps.apple.com/us/app/

Legendary Pines Mastercard

This is a top-tier rewards credit card aimed at affluent travelers who frequently stay at luxury hotels and resorts. Offered exclusively to guests of Legendary Pines properties, this Mastercard provides a range of elite benefits, services, and rewards. Cardholders enjoy complimentary upgrades at Legendary Pines hotels, resort credits to use on services like spa treatments and golf outings, and access to exclusive VIP amenities.

They also earn 3x points per dollar spent on all Legendary Pines purchases and 1x points per dollar on other purchases. Points can be redeemed for free nights, room upgrades, dining, and other rewards at Legendary Pines worldwide locations. With no foreign transaction fees, special Legendary Pines Mastercard member rates and experiences, and a range of luxury privileges, this card offers an elevated travel rewards program for frequent guests at these premium properties.

What is the Legendary Pine MasterCard?

Legendary Pine MasterCard wants to change the way people use credit cards. Pine makes a platform for people, businesses, and banks by bringing blockchain technology into the area. The platform uses a smart contract method that lets users do business without using a third party to pay.

Gander Mountain Credit Card Legendary Pine

The Gander Mountain Credit Card, often hailed as the “Legendary Pine” in the world of outdoor enthusiasts, stands as a symbol of convenience and savings for those who embrace the wilderness. This card not only offers the financial flexibility to fuel one’s passion for outdoor adventures but also unlocks a treasure trove of rewards and benefits.

Whether you’re an avid camper, hiker, angler, or simply a lover of the great outdoors, the Gander Mountain Credit Card, with its legendary pine emblem, is your key to unlocking exclusive deals on gear, equipment, and experiences that will elevate your outdoor pursuits to new heights. Every swipe reinforces the spirit of adventure and exploration that defines the Gander Mountain brand.

Gander Mountain MasterCard from a community bank

This is a card from Comenity Bank that lets you earn points. Read on to find out if the Gander Mountain credit card is the best one for you.

Key takeaways

Competitive APRs: The buying APR for the Gander Mountain Mastercard from Comenity Bank can be anywhere from 16.99% to 24.99%.

No fee per year: This is a good choice for people who want an easy-to-use credit card. It gives you benefits for the things you buy, but you don’t have to pay a fee every year to use them.

There are no foreign transaction fees: This card doesn’t charge a fee when you make a purchase that goes through a foreign bank or is in a currency other than the U.S. dollar (USD). This makes it a great credit card to have when going abroad.

You need good credit or better. If your credit score is below 700, your chances of getting a loan are low.

On SuperMoney, you can no longer sign up for a new Gander Mountain Mastercard from Comenity Bank.

Is there a bonus for signing up for the Gander Mountain credit card?

There is no cash bonus for signing up for this card.

Is there a reward for using the Gander Mountain credit card every year?

There is no cash reward bonus with this card.

What are the perks of the Gander Mountain credit card?

It has the following advantages:

- Help in an Emergency

- Zero fraud risk

Legendary Pine MasterCard rewards

- 3 points for every dollar spent at any store that qualifies.

- 2 points for every dollar spent at gas stations and shopping stores.

- Everywhere else MasterCard is accepted, you get 1 point for every $1 you spend.

You can pay bills with your Legendary Pine MasterCard Login.

Sign in to your account when you’re ready to pay your Legendary Pine credit card bill online. After logging in to your account, you’ll be able to see your spending information, such as when your bills are due and how much you’ve paid in the past. You can also pay your bill online by entering the information from your bank account on the page. Legendary Pine makes it easy to keep track of your credit card payments by putting everything on a single screen.

If you need additional assistance, contact Customer Care

Customer Care

1-866-587-8850

TDD/TTY

1-800-695-1788

Customer Service Hours

24 x 7 x 365

During holidays, the hours of Live Customer Care may be different. Automated customer service is available every day of the year, 24 hours a day, and 7 days a week.

Customer Care Address

Comenity Bank

PO Box 182273

Columbus, OH 43218

FAQs

1. What do I do if I can’t get into my account?

If multiple people have tried and failed to sign into your account, temporarily block access to your online account for your safety. Send a message to the email address we have on file for your account with the steps.

2. My payment is due today. What do I need to do to pay online and not get a late fee?

To escape paying a late fee, you must pay at least the minimum amount due on or before the due date and before 5:00 p.m.

3. When do my points expire?

In most cases, points will end 36 months after they are added to your account.

4. Can I pay my bills online on the weekends or holidays?

Yes, you can pay bills online 7 days a week.

To avoid a late payment fee, payments must be accepted and processed by 5:00 p.m. Eastern Time (ET) on or before the due date.

5. Can an online payment be made from a bank that is not in the United States?

At this time, Legendary Pine can’t take internet payments from banks outside of the United States. You can make an internet payment even if you are outside the country.

Conclusion

Legendary Pine now accepts credit card purchases on its website. If you want to take advantage of this brand-new and highly useful service, you’ll need to create an account online. Creating an account is a simple, safe, and fast procedure that can be done entirely in an online environment. To sign up for an online account with Legendary Pine MasterCard, just follow the outlined steps above.