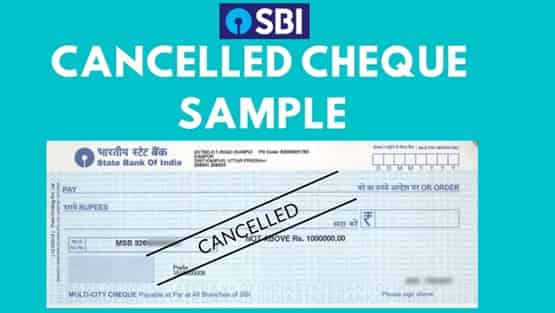

What is a Cancelled Cheque?

A cancelled cheque is a personal or business cheque that has been marked “cancelled” and is no longer valid for payment. And a cancelled check is one from your chequebook tied to a certain bank and has two parallel lines drawn diagonally across it. Between the two lines, the word “CANCELLED” is written in a capital letter. A cheque that has been returned has:

- Your bank account number.

- The name of that bank.

- The account holder’s name.

- The bank’s MICR code.

How to Cancelled Cheque?

In case of a lost or stolen cheque, the SBI provides its customers with the facility of cancelling the cheque. To do this, the customer has to visit their SBI branch in person and provide a written request to cancel the cheque. The request must include the customer’s name, account number, and cheque number that is to be withdrawn. The bank will then cancel the cheque and issue a new one to the customer.

What does a Cancelled cheque look like?

The methods of issuing a Cancelled cheque are pretty simple and are discussed below:

Cheque Book holding: To write a cancelled check, you must have an SBI chequebook with the right chequebook facility.

Parallel Lines Input: To cash a check issued by SBI, you must first use black or blue ink to draw two parallel lines across the check’s diagonal. You should be able to fit some writing material in the gap between the two lines.

Writing: Write the word “CANCELLED” between the two parallel lines on the SBI cheque in all caps form or sentence.

Signature issues: You should not sign your SBI cheque, which you are cancelling. This may lead to may fraud intentional cases.

What happens if I don’t have a Cancelled cheque?

If you don’t have a cancelled check, it can be hard to do financial transactions that require proof of identity, address, and bank account information. In these situations, you may need to show proof differently, like a bank statement or a letter from your bank.

In some cases, the bank may offer other ways to verify your bank account information, such as sending a “letter of authorization” or a “bank confirmation letter.” These papers are proof that you have a bank account. They are given to you by the bank. But the specific options you have may change based on the needs of the person or organization you are dealing with and the rules of your bank.

A cancelled check is a good thing to keep on hand because it can be used as proof of your bank account information. If you don’t have one, you should check with your bank to see what other options you have.

Also Read: Harbor Freight Credit Card Review

Can a Cancelled cheque be bounced?

No, a cancelled cheque cannot be bounced. A bounced cheque refers to a situation where a cheque is returned by the bank due to insufficient funds in the account or some other issue with the cheque itself. On the other hand, a cancelled cheque is simply a cheque that has been marked “cancelled” by the bank and is no longer valid for payment. The purpose of a cancelled cheque is to provide proof of identity, address, and bank account details for various financial transactions, and not to make a payment. As such, a cancelled cheque cannot be bounced as it is not being used for payment purposes.

How much is a Cancelled check fee in India?

The fee for obtaining a cancelled cheque in India may vary depending on the policies of the specific bank you are dealing with. Some banks may charge a nominal fee for issuing a cancelled cheque, while others may provide this service for free.

It is important to note that the fee for obtaining a cancelled cheque is usually a one-time charge and is relatively small compared to the benefits that come with having a cancelled cheque.

Why is a Cancelled cheque required?

A cancelled cheque from the SBI is often required as proof of identity, address, and bank account details for various financial transactions. For example, it is required for opening a fixed deposit, processing a loan application, availing the benefits of direct deposit services, and setting up automatic payments. In these cases, the cancelled cheque serves as proof of the authenticity of the customer’s bank account information.

Can you cash a cancelled check?

No, you cannot cash a cancelled check. A cancelled check is simply a cheque that has been marked “cancelled” by the bank and is no longer valid for payment. The purpose of a cancelled check is to provide proof of identity, address, and bank account information for various financial transactions, and not to make a payment.

If you try to cash a cancelled check, it will be rejected by the bank and will not be honored for payment. To receive payment for a cheque, it must be an uncancelled, valid cheque that has not been marked “cancelled” by the bank.

In case of a lost or stolen cheque, it is important to immediately inform your bank and request that the cheque is cancelled to prevent any unauthorized use. The bank will then cancel the cheque and issue a new one to you.

How to obtain a cancelled cheque from the SBI:

Customers can write a cheque in their name and present it to the bank for cancellation. The bank will then mark the cheque as “cancelled” and return it to the customer. The cancelled cheque can then be used as proof of identity, address, and bank account details.

It is time to know the online procedure where you do not make the cheque cancelled but order it online.

- The bank takes copies of your Cancelled Cheque once in all for the use of 7 years.

- It would help if you started working on online banking services from home.

- You can visit the customer service section and click on “order copy of the check.”

- Choose the type of cheque and your account for the detailing.

After following the above steps, you can quickly get a Cancelled cheque online. Both the online and offline processes are easy and convenient for bank users.

Conclusion

A cancelled cheque is a commonly accepted form of proof of bank account information in India and is often required for various financial transactions. Obtaining a cancelled cheque is a simple process and can usually be done by writing a cheque to yourself and depositing it into your bank account. While some banks may charge a fee for issuing a canceled cheque, the benefits of having one make it a small price to pay.

In case of a lost or stolen cancelled cheque, it is important to immediately inform your bank and request that the cheque is cancelled to prevent any unauthorized use. Overall, a cancelled cheque is an important document to have on hand and can simplify many financial transactions.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.