Multiple sources say that the government has lifted blocking orders on at least seven money-lending platforms that were affected by the recent crackdown on 94 loan apps. This happened after the government looked at their documents to ensure they followed internet and finance laws.

Late on Thursday, the ministry confirmed the relief to the players over the phone. On Friday, internet service providers confirmed it. Even though the platforms are still waiting for a written message, it has been confirmed that the blocking order has been removed from Kissht, LazyPay, and Indiabulls Home Loans’ websites and mobile apps.

After hearing from each platform by the procedure, a judgment has been made. Any platform may request a review of the ruling and file an appeal if it does not agree with it. According to a senior government official, it is the committee’s responsibility to determine whether or not a site complies with legal standards.

The Ministry of Electronics and Information Technology (MeitY) earlier this week issued blocking orders against 138 betting and 94 loan apps saying “links with China”, and claimed “involvement in money laundering” and presenting a “threat to financial security”.

India’s government and MeitY for removing the order to block Kissht. The government has been very helpful in making sure that trustworthy and legal apps like Kissht keep working to make money easier for more people in the country.

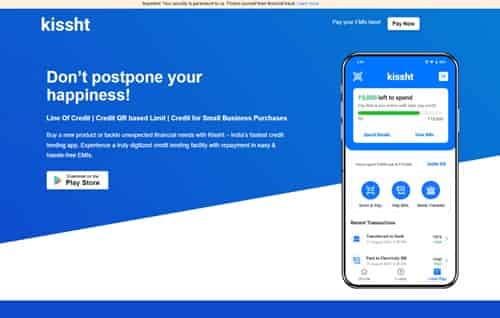

Kissht App Review: Is It Real or Fake App?

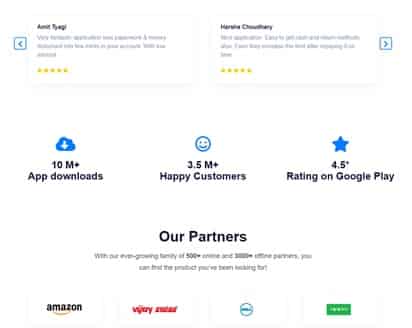

The Kissht loan app is real and can be downloaded from both the Google Play Store and the Apple App Store. It is made and run by Kissht Private Limited, a registered Non-Banking Financial Company (NBFC) that is regulated by the Reserve Bank of India (RBI). The app makes it easy and quick for qualified borrowers to apply online for personal loans, loans for consumer durables, and business loans.

Once the loan is approved, the money is sent to the borrower’s bank account within 24 to 48 hours. So, the Kissht loan app is a legitimate and trustworthy way for people to get help with money.

Founder of Kissht app

Krishnan Vishwanathan and Ranvir Singh, who also started Kissht Private Limited, made the Kissht loan app. The company’s Chief Executive Officer (CEO) is Krishnan Vishwanathan, and the Chief Operating Officer is Ranvir Singh (COO). Before starting Kissht Private Limited, they both worked for different companies in the financial technology field and gained a lot of experience.

Since it started in 2015, the company has become one of the most popular digital lending platforms in India, giving loans to people, small businesses, and merchants all over the country.

What is a Kissht loan app?

Kissht is a digital lending platform that lets people get loans for things like personal, educational, medical, and consumer durable needs, among other things. Customers can use the Kissht app to apply for a loan online and get approval in just a few minutes.

Kissht uses technology to figure out a person’s creditworthiness and gives them a loan amount based on whether or not they are eligible. The app also lets you pay back what you owe in easy installments. Kissht also works with different businesses to help them offer loans for their goods and services.

Loan amount range

For personal loans and loans for consumer durables, the maximum loan amount can be up to 5 lakhs. For business loans, the maximum loan amount can be higher. The actual loan limit for each borrower is based on things like their credit score, income level, history of making payments, and other things that the lender may take into account. Before you apply for a loan through the app, you should check the criteria for who can get a loan and how much you can borrow.

How to login and download the app

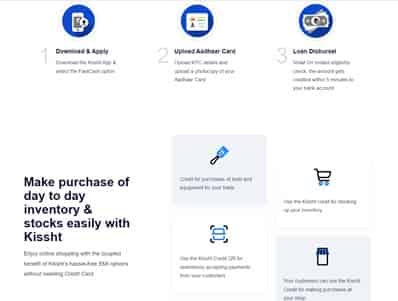

Follow these simple steps to get a loan through the Kissht loan app:

- You can get the Kissht loan app from the Google Play Store or the Apple App Store and install it on your phone.

- Sign up for the app by giving your phone number, email address, and any other needed information.

- Once you’ve signed up, you can log in to the app and choose what kind of loan you want to apply for (personal loan, consumer durable loan, or business loan).

- Fill out the online loan application form with your name, address, income, and any other relevant information about yourself and your finances.

- Upload the necessary documents, such as proof of identity, proof of address, proof of income, and any other documents asked for by the lender.

- Look over the loan application and send it in.

- After you send in your application and documents, the lender will check them over.

- If your loan request is accepted, the money will be sent to your bank account within 24 to 48 hours.

How does it work?

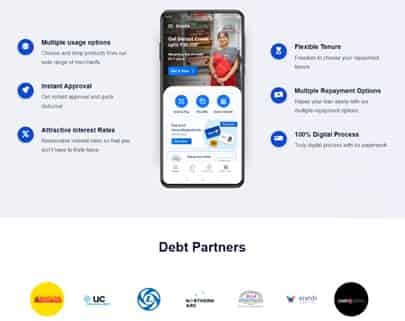

Salient Features

Customer reviews

Criteria for eligibility

Whether or not you can use the Kissht app to apply for a personal loan may depend on the lender and the amount of the loan. But here are a few of the general requirements:

Age: At the time the loan is due, you must be at least 21 years old and no more than 58 years old.

Employment: You should be a salaried employee of a company or a self-employed professional or business owner with a minimum income set by the lender.

Score: You should have a credit score of at least 650. Your chances of getting a loan and your interest rate may both go up if you have a higher credit score.

Residence: You should live in India and have a valid proof of residence.

Documents: To apply for a loan, you need to have a valid PAN card, an Aadhaar card, and information about your bank account.

Note: The rules for who can get a loan depend on the lender and the amount of the loan. Before applying for a loan, you should check the lender’s website or the Kissht app to see if you meet the specific requirements.

The pros and cons of using the Kissht loan app:

| Pros | Cons |

| Easy and convenient | Eligibility criteria may be stringent |

| Quick approval and disbursement | Late payment charges may be levied |

| Flexible repayment options | A processing fee may be charged |

| Competitive interest rates | The loan amount may be limited |

| Multiple loan options | Dependency on technology |

Note: This table is based on the general pros and cons of using the Kissht loan app, and the actual pros and cons may vary depending on the lender and the loan product.

Does India ban the Kissht app?

There was no news or reports of the Kissht app being banned in India. Kissht Private Limited, a registered Non-Banking Financial Company (NBFC) that is regulated by the Reserve Bank of India, made and runs the Kissht loan app (RBI). But rules and regulations about how mobile apps and financial technology platforms can be used can change over time.

Therefore, it is recommended to check for the latest updates or news regarding the Kissht loan app’s status in India before using the app or applying for a loan.

Conclusion

In conclusion, the Kissht loan app is a legitimate and trustworthy place where eligible borrowers can get personal loans, loans for consumer durables, and business loans. With the app, you can apply for loans online quickly and easily from the comfort of your own home. The Kissht loan app can be a great choice for people who need money because it offers flexible ways to pay back the loan, competitive interest rates, and quick approval and payment.

But borrowers must meet the requirements to be eligible, and they should read the terms and conditions carefully before applying for a loan to avoid any problems. Even though there are some problems with the Kissht loan app, such as the possibility of strict eligibility requirements and processing fees, the pros outweigh the cons.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.