7 Rules of Money

There are a few simple rules about money that can help you keep track of your money and build wealth over time. Here are a few of the most important:

- One of the most important rules of money management is to spend less than you earn. Try to spend less than you earn at all times. This will help you stay out of debt and save money.

- Make a budget. A budget can help you keep track of your money coming in and going out. It can also help you figure out where you can save money by cutting back on spending.

- Save often: Making saving a habit is important. Even if it’s just a small amount, you should try to save some of your money every month. Your savings will help you reach your financial goals over time.

- Invest wisely: Putting your money into investments can help you get richer over time. But it’s important to invest wisely and do research before deciding what to invest in.

- Avoid getting into debt. Debt can make it hard to build wealth. If you do need to take on debt, make sure you can afford the payments and have a plan to pay it off as soon as possible.

- Be ready for emergencies. It’s important to have a fund to cover expenses that come up out of the blue. This can help you avoid going into debt or spending your savings.

- Don’t try to keep up with the Joneses; live within your means. Instead, live within your means and don’t spend money you don’t need to. You’ll be able to save more money and get richer over time.

By following these simple rules about money, you can get your finances in order and build a solid foundation for the future.

Money Management Rules

Money management is a key skill that can help you make the most of your income and reach your financial goals. Here are some important rules to remember about how to handle money:

- Make a budget. A budget can help you keep track of your income and expenses and make sure you’re not spending too much in any area. To make a budget, you can use a spreadsheet, an app, or just a pen and paper.

- Set your spending priorities: Make sure your essential costs (like rent, utilities, and food) are covered by your budget before you set aside money for extras. This will help you make sure you pay your bills and don’t waste money on things you don’t need.

- Avoid getting into debt. Debt can quickly add up and become hard to handle. Try not to get into debt, and if you do, make sure you have a good plan for how to pay it back.

- Save money for emergencies. Unexpected costs can throw your budget off track, so it’s important to have a fund for these situations. Aim to save at least three to six months’ worth of living costs in a separate account that you can easily access in case of an emergency.

- Save for the future: Saving for the future can help you reach your financial goals, like buying a house, starting a business, or retiring comfortably. Look into different ways to invest your money so that it can grow over time.

- Avoid “lifestyle inflation.” As your income goes up, it can be tempting to start spending more on luxury items. But it’s important to keep your lifestyle from getting too expensive and to live within your means.

- Be aware of how much you spend. Pay attention to how you spend your money and make changes as needed. For example, if you spend too much on eating out, try making more meals at home.

By following these rules for managing your money, you can get a handle on your finances and work towards a more secure future.

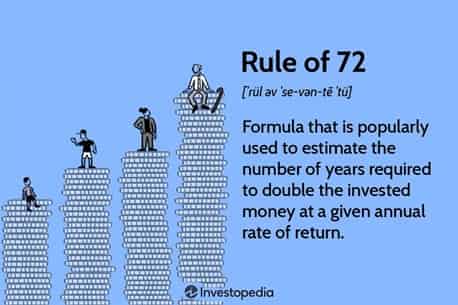

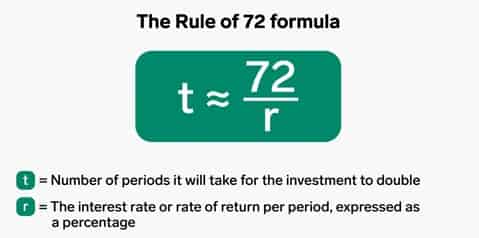

Rule of 72 for doubling your money

Based on an investment’s annual rate of return, the “Rule of 72” is a quick way to estimate how long it will take for its value to double. It’s a good way to see how powerful compound interest can be.

Divide 72 by the annual rate of return to use the Rule of 72. The number you get is how many years it will take for your money to double in value.

For example, if you have an investment that gives you a return of 6% per year, you can use the Rule of 72 to figure out that it will take your investment about 12 years to double in value (72 divided by 6 equals 12).

The Rule of 72 is not a perfect way to figure out how much your investments could grow, but it can give you a quick and easy way to do so. Remember that investment returns can be hard to predict and can change from one year to the next. Before investing, it’s always important to do your research and talk to a financial expert.

Rules of thumb for saving money

There are a lot of general rules for saving money, but here are some of the most common ones:

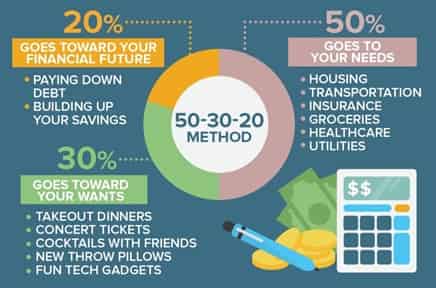

- The rule of 50/30/20: This rule says that you should split your income after taxes into three parts: 50% for necessities (like housing, utilities, and food), 30% for extras (like eating out, entertainment, and hobbies), and 20% for savings and paying off debt.

- The 20% rule says that you should save at least 20% of your monthly income after taxes. This can help you build a good emergency fund and work towards your long-term financial goals.

- The $1,000 rule says that you should have at least $1,000 saved for emergencies. This can help you pay for unexpected costs like car repairs or medical bills without using credit cards or other debt.

- The 30-day rule says that you should wait 30 days before buying something that isn’t necessary. This can help you avoid buying things on the spot and give you time to think about whether you need the item.

Keep in mind that these are just general rules, and they might not work for everyone. It’s important to find a way to save money that fits your needs and financial goals.

Conclusion

In the end, many money rules can help you manage your money well and reach your financial goals. Some of the most important money management rules are to spend less than you earn, make a budget and stick to it, avoid debt as much as possible, build an emergency fund, invest for the future, and stay informed about personal finance and investment strategies.

By following these rules and building good money habits, you can take control of your finances, reduce financial stress, and build a solid financial foundation for the future. Don’t forget that achieving financial success is a process that takes discipline, patience, and persistence. You can reach your financial goals and have a more secure and prosperous future, though, if you work hard and are committed.