Challan 280 is a form used by individuals and businesses in India to make payments towards direct taxes, including income tax. It is a standardized form prescribed by the Income Tax Department of India and is used to deposit taxes into the government’s account. Challan 280 is a mandatory form to be used for paying various types of taxes, including regular assessment tax, self-assessment tax, advance tax, and tax on deemed income.

The form must be filled out accurately, and the tax payment must match the details mentioned in the tax return filed by the individual or business. The form can be filled out either physically or online, and the tax can be paid through various modes of payment, such as net banking, credit card, or debit card.

How to use Challan 280 to pay income tax challan online

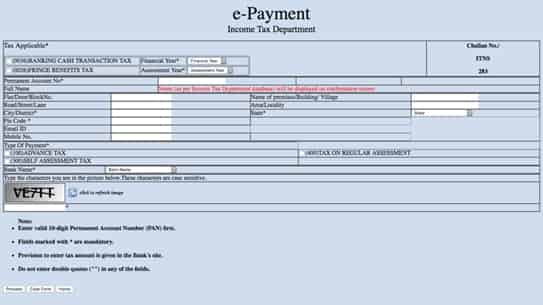

Here are the steps to pay income tax using Challan 280 online in India:

- Visit the official website of the National Securities Depository Limited (NSDL) at https://www.tin-nsdl.com/

- Click on the “e-Payment (Direct Tax)” link on the homepage.

- Select the appropriate challan, which is Challan 280 for income tax payment.

- Fill in the required details in the Challan 280 form, including your PAN number, assessment year, and the amount of tax to be paid.

- Select the mode of payment, such as net banking, credit card, or debit card.

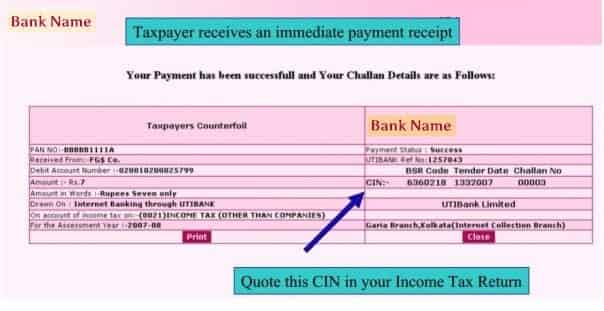

- Once you have filled in the details and made the payment, you will receive a confirmation receipt with a Challan Identification Number (CIN).

- Keep the CIN safe for future reference as proof of payment.

It’s important to note that the income tax payment made using Challan 280 should match the details mentioned in the tax return filed by you.

How to fill challan 280 offline?

To fill Challan 280 offline, follow these steps:

- Obtain a physical copy of the Challan 280 form from a bank branch, or you can download it from the official website of the Income Tax Department of India.

- Fill in the required details, including the name and PAN number of the taxpayer, the assessment year, and the amount of tax to be paid.

- Select the type of tax being paid, such as regular assessment tax, self-assessment tax, advance tax, or tax on deemed income.

- Make sure that the tax payment details match the information mentioned in the tax return filed by the taxpayer.

- Take the filled-out Challan 280 form to a designated bank branch authorized by the Income Tax Department to make tax payments.

- Pay the tax by cash, cheque, or demand draft. In case of a cheque or demand draft, make sure that it is issued in favor of “The Payment Collector of Income Tax”.

- Obtain a receipt from the bank, which will serve as proof of payment. The receipt will have a Challan Identification Number (CIN), which should be kept safely for future reference.

It’s important to note that the tax payment must be made within the specified due date to avoid interest and penalties.

How can I download challan 280?

Challan 280 can be easily downloaded from the official website of the Income Tax Department of India. Here are the steps to download Challan 280:

- Visit the official website of the Income Tax Department of India at https://www.incometaxindia.gov.in/

- Click on the “Downloads” tab on the homepage.

- Select “Forms” from the drop-down menu.

- Scroll down to the “Challans” section and click on “Challan 280 – Payment of Advance Tax, Self-Assessment Tax, etc.”

- The Challan 280 form will open in a PDF format, which can be saved or printed as per your preference.

It’s important to make sure that you download the latest version of the Challan 280 form, as it is updated periodically by the Income Tax Department. The filled-out form must match the details mentioned in the tax return filed by you.

How can I file ITR after paying challan 280?

After paying Challan 280 for the payment of your income tax, you need to file an Income Tax Return (ITR) to complete the process of tax payment and filing. Here are the steps to file your ITR after paying Challan 280:

- Gather all the necessary documents, such as Form 16 (if you are an employee), bank statements, investment proofs, and other relevant documents.

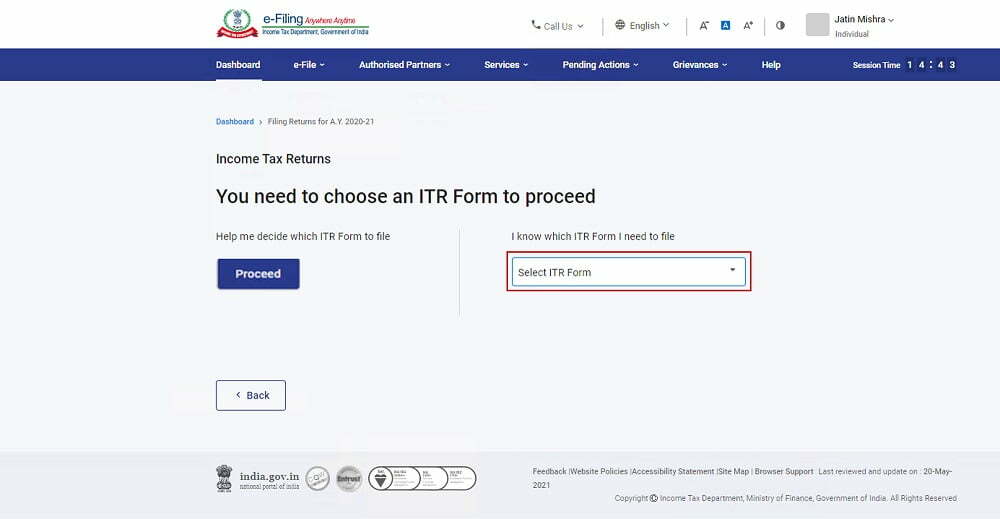

- Determine the correct ITR form to be used based on your source of income and tax liability. You can find the available ITR forms on the official website of the Income Tax Department of India.

- Visit the official e-filing portal of the Income Tax Department of India at https://www.incometaxindiaefiling.gov.in/

- Register yourself on the portal, if you haven’t already, by providing your personal and contact details.

- Log in to the portal and click on the “File Return” tab.

- Select the relevant assessment year and the ITR form.

- Fill in the required details in the ITR form, including your personal and financial details, tax payments made using Challan 280, and other relevant information.

- Upload the necessary documents, such as Form 16 and investment proofs.

- Verify the details and submit the ITR.

Once your ITR has been successfully submitted, you will receive an acknowledgment receipt with a unique ITR-V number. Keep the ITR-V number safe for future reference. It’s important to note that the ITR must be filed within the specified due date to avoid interest and penalties.

What is the difference between challan 280 and 281?

Challan 280 and Challan 281 are both used for paying direct taxes in India. However, there are some differences between the two challans:

Challan 280: Challan 280 is used for payment of taxes such as advance tax, self-assessment tax, and regular assessment tax, among others. It can be used for all types of tax payments and is the most commonly used challan for direct tax payments in India.

Challan 281: Challan 281 is used specifically for the payment of TDS (Tax Deducted at Source) or TCS (Tax Collected at Source). It is used by employers, contractors, and other entities that are required to deduct tax at source while making payments to individuals or entities.

So, in summary, Challan 280 is used for a variety of direct tax payments, while Challan 281 is specifically used for TDS or TCS payments. It’s important to use the correct challan for your tax payment to ensure that it is processed correctly by the Income Tax Department of India.

General FAQs

What is Income-tax?

It is a tax levied by the Government of India on the income of every person. The provisions governing the Income-tax are covered in the Income-tax Act, of 1961.

What is the administrative framework of Income-tax?

The revenue functions of the Government of India are managed by the Ministry of Finance. The Finance Ministry has entrusted the task of administration of direct taxes like Income-tax, Wealth tax, etc., to the Central Board of Direct Taxes (CBDT). The CBDT is a part of the Department of Revenue in the Ministry of Finance.

CBDT provides essential inputs for policy framing and planning of direct taxes and also administers the direct tax laws through the Income-tax Department. Thus, Income-tax Law is administrated by the Income-tax Department under the control and supervision of the CBDT.

What is the period for which a person’s income is taken into account for Income-tax?

Income tax is levied on the annual income of a person. The year under the Income-tax Law is the period starting from 1st April and ending on 31st March of the next calendar year. The Income-tax Law classifies the year as (1) the Previous year, and (2) the Assessment year.

The year in which income is earned is called the previous year and the year in which the income is charged to tax is called an assessment year.

e.g., Income earned during the period of 1st April 2021 to 31st March 2022 is treated as income of the previous year 2021-22. Income of the previous year 2021-22 will be charged to tax in the next year, i.e., in the assessment year 2022-23.

Who is supposed to pay Income-tax?

Income tax is to be paid by every person. The term ‘person’ as defined under the Income-tax Act under section 2(3) covers in its ambit natural as well as artificial persons.

To charge Income-tax, the term ‘person’ includes Individual, Hindu Undivided Families [HUFs], Association of Persons [AOPs], Body of individuals [BOIs], Firms, LLPs, Companies, Local Authorities and any artificial juridical person not covered under any of the above.

Thus, from the definition of the term ‘person’ it can be observed that, apart from a natural person, i.e., an individual, any sort of artificial entity will also be liable to pay Income-tax.

How does the Government collect Income-tax?

Taxes are collected by the Government through three means: a) voluntary payment by taxpayers into various designated Banks. For example, Advance Tax and Self-Assessment Tax paid by the taxpayers, b) Taxes deducted at source [TDS] from the income of the receiver, and c) Taxes collected at source [TCS]. It is the constitutional obligation of every person earning income to compute his income and pay taxes correctly.

Is there any special benefit available under the Income-tax law to senior citizens?

Yes, the Income-tax Law very well takes care of the senior citizens of the nation by offering them several tax benefits. In this part, you can gain knowledge of various benefits offered by the Income-tax Law to senior citizens.

Is a very senior citizen granted exemption from e-filing of income tax returns?

A very senior citizen filing his return of income in Form ITR 1/4 can file his return of income in paper mode, i.e., for him e filing of ITR 1/4 (as the case may be) is not mandatory. However, he may go for e-filing if he wishes.

Will I be put to any disadvantage by filing my return?

No, on the contrary by not filing your return despite having taxable income, you will be liable to the penalty and prosecution provisions under the Income-tax Act.

What are the benefits of filing my return of income?

Filing of return is your duty and earns you the dignity of consciously contributing to the development of the nation. Apart from this, your income-tax returns validate your creditworthiness before financial institutions and make it possible for you to access many financial benefits such as bank credits, etc.

What are the benefits of e-filing the return of income?

E-filing can be done from any place at any time and it saves time and effort. It is simple, easy, and faster. The e-filed returns are generally processed faster as compared to returns filed manually.

Is it necessary to file a return of income when I do not have any positive income?

If you have sustained a loss in the financial year, which you propose to carry forward to the subsequent year for adjustment against subsequent year(s) positive income, you must claim loss by filing your return before the due date.

If I have paid excess tax how will it be refunded to me?

The excess tax can be claimed as a refund by filing your Income-tax return. It will be refunded to you by crediting it to your bank account through an ECS transfer. The department has been making efforts to settle refund claims at the earliest.

Also Read: 5 Best Keys To Financial Success In 2023

Conclusion Income tax challan 280

Online Income tax challan 280 is a convenient and easy way to pay income tax in India. It can be filled out and submitted online through the NSDL or the Income Tax Department’s e-filing website. Payment can be made through various modes such as internet banking, debit card, credit card, or other online payment options. The online form pre-fills certain details based on the PAN number entered, and it is important to ensure that the correct details are filled in the challan to avoid any discrepancies. Using the online method also offers the benefit of immediate confirmation of payment.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.