Spring EQ Reviews: A Comprehensive Guide 2023

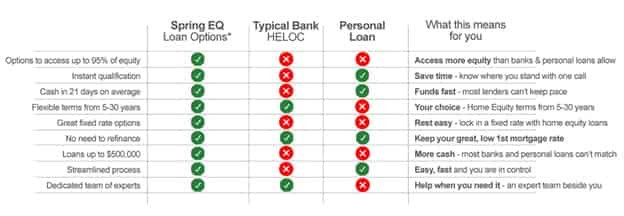

Spring EQ: A lot of people turn to Spring EQ when they need a home equity loan because of how well-liked the firm is. Spring EQ has quickly become popular among homeowners wishing to access their home equity for a variety of reasons due to their straightforward application procedure and low-interest rates. In this post, we’ll take a look at Spring EQ from the perspective of their previous clients and provide you with an in-depth analysis of their offerings.

Ease of Use:

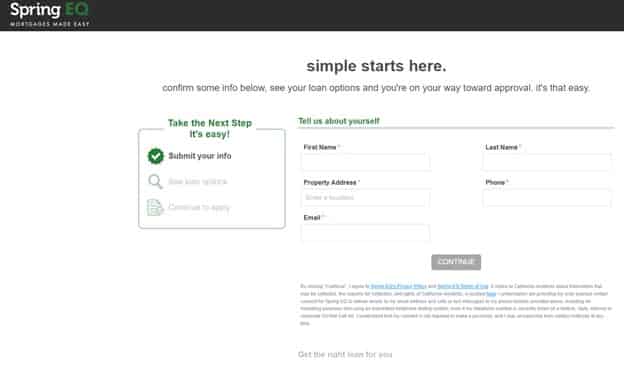

Spring EQ’s online platform is incredibly simple to use, which is one of the service’s main selling points. There is no complicated paperwork involved, and buyers can get authorized in a matter of minutes. Furthermore, if a loan is accepted, the procedure is expedited and consumers may expect to get their funds within a matter of business days. Customers have expressed their gratitude for the ease with which they were able to obtain the monies they required.

Interest Rates and Fees

Spring EQ also offers reasonable interest rates and a clear charge schedule. When comparing Spring EQ to other home equity loan providers, their interest rates and fees are far more competitive. Because of this, Spring EQ has become a popular choice for people who want to borrow against their home’s equity but don’t want to pay exorbitant interest rates and fees.

Customer Support

When it comes to customer support, Spring EQ shines. Their team is knowledgeable, friendly, and available to answer any questions or concerns customers may have. Whether it’s via phone, email, or live chat, the Spring EQ team is always available to provide help and guidance. This level of customer support has been highly appreciated by past customers, who have praised the company for its excellent service.

Repayment Terms:

Finally, Spring EQ offers flexible repayment terms, allowing customers to choose a repayment period that suits their needs and budget. This flexibility has been appreciated by customers, who have stated that they appreciate being able to choose a repayment term that works for them. Furthermore, Spring EQ allows customers to make extra payments without penalty, which has been a big selling point for many.

The login process for Spring EQ is simple. To log in to your account, follow these steps:

- Visit the Spring EQ website: Go to the Spring EQ website (www.springeq.com) and click on the “Sign In” button located in the top right corner of the homepage.

- Enter your email address: On the login page, enter the email address that you used to create your Spring EQ account.

- Enter your password: Next, enter your password in the provided field. If you have forgotten your password, click on the “Forgot Password” link and follow the instructions to reset it.

- Click “Sign In”: Once you have entered your email address and password, click on the “Sign In” button.

- Verify your identity: To ensure the security of your account, you may be asked to verify your identity by providing additional information.

- Access your account: If you have successfully logged in, you will be taken to your account dashboard where you can view your loan information, make payments, and more.

If you encounter any issues during the login process, you can contact Spring EQ’s customer support team for assistance. They are available to help you resolve any issues and ensure a seamless experience.

Payment Options

- Recurring and One-Time Payment

To request to make recurring or one-time ACH payments toward your home equity loan or second mortgage, you can complete our ACH authorization form.

To request to make recurring or one-time ACH payments on your first mortgage, purchase or refinance loans, call us at 1-855-463-7407 and we will guide you through the process of setting up an ACH authorization.

Once complete, you can choose between one-time or automatic recurring payments so you never have to worry about being late on a payment again.

2. Pay by phone

Please call us at 1-855-463-7407 if you would like us to coordinate payment for you.

3. Bill Pay/Mail a check

To set up bill payment from your bank account or to mail a check, please make payable to Spring EQ at the following address:

Spring EQ

ATTN: Servicing

100 W Matsonford Rd, Bldg 5 Ste 100

Radnor, Pennsylvania 19087

Please include your Loan Number to assure that your payment is credited to the appropriate loan.

While we are unable to set up Bill Pay for borrowers through Spring EQ, we do accept Bill payments. Please contact your Financial institution for assistance setting up Bill pay.

Online Payments

Currently, Spring EQ does not offer online payments. By popular demand, this is a feature that we are diligently working on and should be able to offer soon! If you are looking to set up your payments, we recommend signing up for our Recurring payment option.

Loan Payoff

Payoffs can be requested through email: Servicing@Springeq.com or by phone: 1-855-463-7407.

Please provide the following information in your request:

- Name

- Loan Number

- Contact Number

- Payoff thru date

- Signed Borrower’s Authorization Form

Note: if a Loan PayOff is from a third party, a Signed Borrower Authorization form must be submitted with the borrower’s authorization releasing this information. This form can be provided by a third party.

Borrowers can request a Loan PayOff statement on their own.

Also Read: What is the Difference Between DUI and DWI?

FAQ’s

How long is spring EQ processing?

Spring EQ lets you qualify for a loan right away and get the money in as little as 11 days. On average, it takes 18 days for a borrower to get their money back. Loans of up to $500,000 are available from the lender.

Which bank owns EQ Bank?

EQ Bank is owned by Equitable Bank, which is a Canadian Schedule I bank headquartered in Toronto, Ontario. Equitable Bank was founded in 1970 and has since grown to become one of Canada’s largest independent alternative lenders. In addition to EQ Bank, Equitable Bank also offers a range of mortgage and commercial lending products to Canadians. The bank is committed to providing its customers with innovative financial solutions and excellent customer service.

What is the debt-to-income ratio for spring EQ?

The debt-to-income (DTI) ratio is a measure of a person’s ability to repay their debts. It is calculated by dividing total monthly debt payments by total monthly income. The higher the DTI ratio, the more debt a person has relative to their income, which can impact their ability to obtain a loan.

Spring EQ does not publicly disclose its specific debt-to-income ratio requirements. However, like most lenders, they take a person’s DTI ratio into account when evaluating loan applications. A higher DTI ratio can indicate a higher level of risk for the lender and may make it more difficult for an applicant to be approved for a loan.

In general, it’s a good idea for borrowers to keep their DTI ratio below 43% to increase their chances of loan approval. This means that total monthly debt payments should not exceed 43% of total monthly income.

If you’re applying for a loan from Spring EQ and are unsure of your DTI ratio, you can calculate it by adding up all of your monthly debt payments (including the proposed loan payment) and dividing that number by your monthly gross income. You can also speak to a representative from Spring EQ for more information on their loan requirements and how your DTI ratio may impact your application.

Is spring EQ a bank?

No, Spring EQ is not a bank. Spring EQ is a financial technology company that offers home equity loans to homeowners. The company uses advanced technology to streamline the loan application process and provide fast and convenient access to funds for home improvement projects.

Instead of depositing money into a savings or checking account like a traditional bank, customers can use Spring EQ loans to finance their home improvement projects and make repayments over time. Spring EQ partners with banks and other financial institutions to originate and service its loans.

While Spring EQ is not a bank, it operates as a lender and offers loans to eligible borrowers. If you’re considering a home equity loan, you can visit the Spring EQ website or speak with a representative to learn more about the products and services they offer and how they can help you achieve your financial goals.

What is the meaning of HELOC?

HELOC stands for Home Equity Line of Credit. It is a type of loan that allows homeowners to borrow money using the equity in their home as collateral.

A HELOC is like a credit card, in that the homeowner can draw on the loan as needed up to a certain limit and only pay interest on the amount they use. The interest rate on a HELOC is typically adjustable and tied to an index such as the prime rate.

HELOCs are often used for home improvement projects, debt consolidation, or other major expenses. Since they are secured by the homeowner’s equity in their property, they typically have lower interest rates compared to unsecured loans such as credit card debt or personal loans.

It’s important to keep in mind that taking out a HELOC increases the amount of debt on your home and can put your property at risk if you are unable to make the loan payments. Before taking out a HELOC, it’s a good idea to carefully consider your financial situation and the terms of the loan to make sure it’s the right choice for you.

How do recurring payments work?

You authorize regularly scheduled charges to your checking or savings account. You will be charged the amount indicated below each billing period. Your payments will be reflected on your next month’s statement and the charge will appear on your bank statement as an “ACH Debit.” You agree that no prior notification will be provided unless the date or amount changes, in which case you will receive notice from us at least 10 days before the payment is collected.

Where do the additional payments I make toward my mortgage go?

Any additional amount paid toward your mortgage will go toward the principal balance.

Why are Online Payments not available yet?

While we do not offer the ability to initiate online payments online at this time, this is a feature that we are looking to offer in the future! If you have any additional feedback for us, please let us know!

If you have any questions or concerns, please call 1-855-463-7407 or email us at Servicing@Springeq.com

How can Current Applicants Contact Spring EQ By Phone?

Current applicants can call Spring EQ at 1-888-978-9978.

How can Existing Customers Contact Spring EQ By Email?

Current Customers can e-mail Spring EQ at Servicing@Springeq.com.

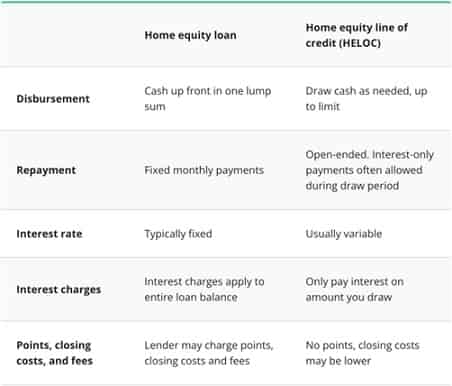

Here’s a comparison of a Home Equity Line of Credit (HELOC) and a Home Equity Loan in table form:

Feature | HELOC | Home Equity Loan |

Repayment Structure | Draw on the loan as needed up to a certain limit; only pay interest on the amount used | Repay a lump sum of cash with interest over a fixed term |

Interest Rates | Typically adjustable and tied to an index such as the prime rate | Usually fixed |

Loan Amount | Variable limit based on the equity in the home and creditworthiness | The fixed amount determined by the lender based on the equity in the home and credit profile |

Purpose | Used for flexible needs such as home improvement projects, debt consolidation, or other major expenses | Used for one-time, large expenses such as a home renovation or a child’s education |

Note: The terms and conditions of HELOCs and home equity loans can vary between lenders. Before taking out either type of loan, it’s important to carefully consider the terms and potential impact on your financial situation.