Sephora Credit Card Review – Is It Worth in 2025?

If you love beauty hauls and spend a lot at Sephora, the Sephora Credit Card or its Visa version might catch your attention. It offers a 25% discount on your first purchase, 4% back in reward dollars on Sephora spending, and no annual fee. But there’s more to the story. High interest rates, expiring rewards, and customer service complaints are things you should know about before applying.

In this review, we’ll break down everything you need to know—the perks, the fine print, and whether it’s actually worth getting for you.

Disclaimer: This article is for informational purposes only and doesn’t count as financial advice. Credit card terms and offers can change, so always double-check details with the official issuer before applying.

What Is the Sephora Credit Card?

The Sephora Credit Card is issued by Comenity Bank and comes in two types:

- Sephora Credit Card (Store Card): Can only be used at Sephora stores and online at Sephora.com.

- Sephora Visa Credit Card: A co-branded Visa that can be used anywhere Visa is accepted, offering broader reward opportunities.

Both versions have no annual fee, making them appealing to Sephora fans who want extra perks for their purchases.

Key Features and Benefits

Let’s go through the highlights that make this card stand out.

1. 25% Off Your First Purchase

Once approved, you get a one-time 25% discount on your first Sephora purchase made with the card. If you’ve been eyeing a big-ticket item or planning a beauty splurge, this initial offer can be a nice boost.

2. Earn 4% Back in Reward Dollars at Sephora

Every time you use the card at Sephora (in-store or online), you earn 4% back in Reward Dollars. For every $125 spent, you receive a $5 reward certificate.

3. Bonus Earnings with Beauty Insider Points

If you’re part of Sephora’s Beauty Insider program, you’ll also earn double Insider points—two points for every dollar spent when you use the Sephora card.

4. Rewards Outside Sephora (Visa Version)

With the Visa version, you earn 1% back in rewards on purchases made anywhere Visa is accepted. It’s not a huge rate, but it’s better than nothing if you want to use the card outside Sephora.

5. No Annual Fee

There’s no yearly charge for having the card, which makes it easier to justify keeping it if you shop at Sephora often.

6. Seamless Integration with Beauty Insider

This card works hand in hand with the Beauty Insider program. You earn your usual Insider points plus the added rewards from the card—basically stacking benefits on top of each other.

7. Rewards Program

All purchases made with a Sephora Credit Card earn extra points, and the cardholder can receive a birthday gift and invitations to special events. Outside of Sephora, cardholders receive one point for every dollar spent.

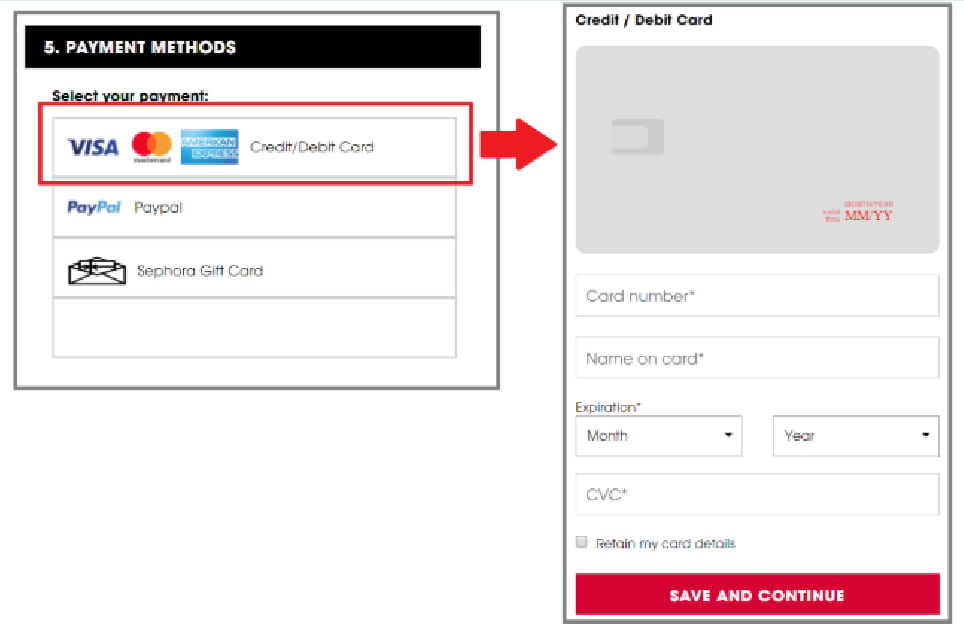

8. Easy Payment Options

If you have a Sephora Credit Card, you can pay for purchases with your Sephora account or the Sephora mobile app. In-store and over-the-phone transactions are also accepted. The Sephora Credit Card provides customers with the option to make payments online through their Sephora account login or through the Sephora app. Payments can also be made in-store or by phone.

9. Customer Service

9. Customer Service

There are many facilities and services available through the Customer Service team at Comenity. In case

- You lost your credit card

- Want to pay your credit card bill

- Want to ask anything related to your credit card

- Want to check your application-related information

- You want to cancel your credit card

- 24/7 customer service to help with any questions or concerns regarding the card or account

Then you may contact the customer service team through the phone numbers below.

| Card type | Helpline number |

| Sephora card | 1-866-702-9946 |

| Sephora Visa card | 1-866-841-5037 |

| Sephora Visa Signature | 1-866-864-7787 |

| TDD/TTY | 1-888-819-1918 |

10. Customer Service Mail Address

Comenity Capital Bank, PO Box 183003, Columbus, OH 43218-3003

Sephora Visa Login: You can use your Sephora Credit Card anywhere that accepts Visa. If you have a Sephora Visa card, you can access your account online and manage your payments and balance.

Comenity Bank

Comenity Bank, a premier issuer of private-label and co-branded credit cards, is behind the Sephora Credit Card. Credit cards for other well-known retailers, including Old Navy, are issued by Comenity Bank as well. Comenity Bank is dedicated to improving the lives of its cardholders via superior customer service.

Here’s a comparison table of the features of the Sephora Credit Card and Visa Card:

| Feature | Sephora Credit Card | Sephora Visa Card |

| Earn points | Sephora stores, Sephora.com, JCPenney | Everywhere Visa is accepted |

| Receive a birthday gift | Yes | No |

| Access to exclusive sales and promotions | Yes | No |

| Access to exclusive events and experiences | Yes | No |

| Redeem points | Sephora stores, Sephora.com, JCPenney | Sephora stores, Sephora.com, JCPenney |

| Special financing options | No | Yes |

| Travel and shopping protections | No | Yes (standard Visa benefits) |

Note: The benefits listed are subject to change and may vary based on location and card

Pros of the Comenity Sephora Credit Card and Visa Card

Pros

| Pros | Explanation |

| Rewards program | Sephora Credit Card holders can earn rewards points on purchases made with their card, which can be redeemed for discounts on future purchases. |

| Exclusive offers and promotions | Sephora Credit Card holders may receive exclusive offers and promotions, such as bonus rewards points, discounts, and early access to sales. |

| Convenient payment options | Sephora Credit Card holders can make payments online, by phone, or by mail, making it easy to manage their accounts. |

Cons

| Cons | Explanation |

| Limited use | The Sephora Credit Card can only be used for purchases at Sephora stores, Sephora.com, and JCPenney locations. |

| Potential for high interest rates | The Sephora Credit Card may have high interest rates, which can result in significant finance charges for cardholders who carry a balance. |

| Annual fee | Some versions of the Sephora Credit Card may have an annual fee, which can be a burden for some cardholders. |

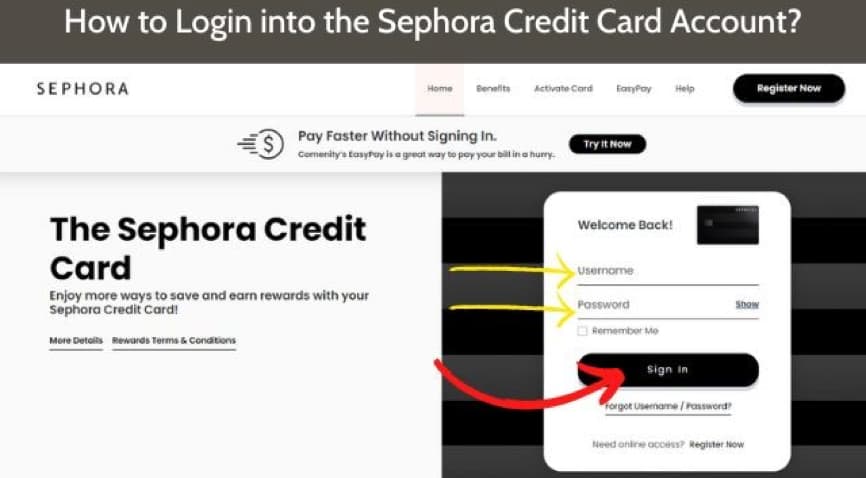

Sephora Credit Card login process

- You can apply for a Sephora credit card by following the “Credit Card” link in the site’s footer.

- Just head to the top right of the website and use the “Sign In” button.

- Complete the blanks with your username and password.

- Access your profile by clicking the “Sign In” button.

Click the “Forgot username/password?” link and then follow the on-screen instructions to reset your login information.

Note: You may also visit the login page directly at https://d.comenity.net/ac/sephoravisa/public/sign-in

Eligibility criteria

The following are the minimum requirements that all new applicants must meet.

To apply, you must be of legal age in your country, state, or territory (often 18–21 years old).

Applicants need a government-issued SSN or SIN in addition to a valid form of identification.

Any applicant who doesn’t provide a physical or postal address will be disqualified. The use of a Post Office Box is not permitted as a postal address.

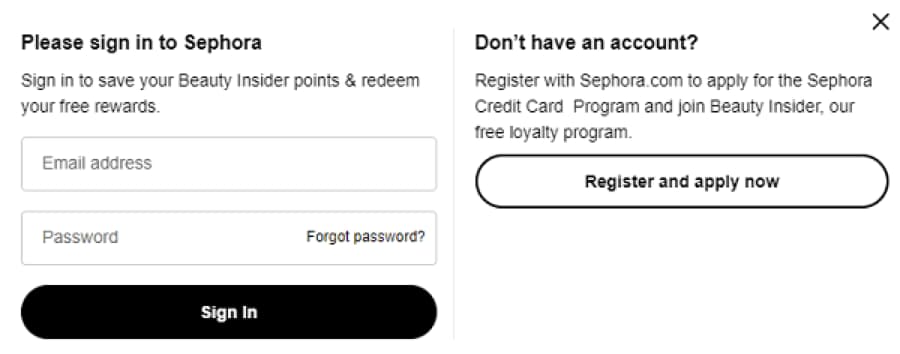

Applications can be submitted in online mode with the help of the steps below.

Step 1: You can pay with a credit card by opening the official website and going to the bottom of the page. Go straight to the credit card page.

Step 2: On the credit card page, click the Apply now link. The “Apply now” link is located in many places on this page.

Step 3: On the next page, you will see a login screen for the new card application (as shown below).

Customers without an existing Sephora account cannot apply for a new credit card. Simply enter your email address and password below to begin the online application process for a credit card.

If you don’t have a Sephora website account, then click the Register and apply now link.

Step 4: Complete the online application, including your contact information, mailing address, and any relevant financial data. Complete the form as accurately as possible.

You should expect to hear back from Comenity on your credit card application status after they’ve reviewed your credit report. Your credit card should arrive between 7 to 14 business days after we’ve received all required permissions.

Who Should Get the Sephora Credit Card?

This card isn’t for everyone. Here’s who it makes sense for—and who should skip it.

Best For:

- Frequent Sephora shoppers who spend consistently throughout the year.

- Beauty Insider members who want to maximize points and rewards.

- Those who always pay their balance in full each month.

- Shoppers are planning a big first purchase to take advantage of the 25% discount.

Not Ideal For:

- People who rarely shop at Sephora.

- Anyone who tends to carry a balance month to month.

- Those looking for a versatile rewards card with better benefits outside Sephora.

- Users who dislike managing multiple rewards programs or short expiration periods.

Tips to Maximize the Sephora Credit Card

If you decide to get this card, here’s how to make the most out of it.

- Use the First Purchase Discount Wisely: Save it for a large purchase like high-end skincare or a fragrance set.

- Pair It with Beauty Insider: You’ll earn both Reward Dollars and Insider points, which can add up fast.

- Redeem Quickly: Keep track of your reward expiration dates—don’t let those 90 days slip by.

- Stick to Sephora Purchases: You’ll get the best return by using it primarily for Sephora spending.

- Pay Off Balances in Full: Avoid interest charges, which can completely erase your rewards.

- Check Store Eligibility: Ensure you’re shopping at qualifying Sephora stores or online to earn full rewards.

Real User Experiences

Many Sephora cardholders have shared their experiences online. Some love the perks; others find it frustrating.

Positive Feedback:

Users who shop often at Sephora appreciate how quickly rewards add up, especially when stacked with Beauty Insider points. The 25% discount is also a major draw for first-time users.

Negative Feedback:

Others say the rewards expire too soon, and the online account portal can be clunky. Late payments lead to high fees, and resolving issues with Comenity Bank’s customer service can take time.

Fine Print You Should Know

Before applying, here are a few key details:

- The 25% first purchase discount is valid for 30 days after approval and cannot be combined with most other promotions.

- Reward Dollars are issued as $5 certificates for every $125 spent at Sephora.

- Reward certificates must be used within 90 days of issuance.

- The store card version cannot be used at Sephora locations inside other retailers.

- Payments cannot be made in Sephora stores—you’ll need to pay online or by mail through Comenity Bank’s system.

- Approval typically requires good credit, though some applicants with fair credit have been accepted.

Is the Sephora Credit Card Worth It?

Here’s the bottom line:

If you’re a loyal Sephora customer who spends regularly and pays your balance in full every month, this card can be worth it. The first-purchase discount and 4% back on Sephora spending can deliver solid value.

However, if you’re looking for a card that offers strong rewards everywhere—not just at Sephora—there are better options. A flat-rate cash-back card or a general rewards card will likely earn you more over time.

The Sephora Credit Card is a specialty tool—great for those who live and breathe Sephora, not ideal as your everyday credit card.

Frequently Asked Questions (FAQs)

Q1: Can I use the Sephora Credit Card outside of Sephora?

Yes, but only if you have the Visa version. The store-only card is limited to Sephora locations and Sephora.com.

Q2: How long do I have to use my rewards?

Once issued, your reward certificate usually expires after 90 days, so use it quickly.

Q3: Does the Sephora Credit Card have an annual fee?

No, there’s no annual fee for either version of the card.

Q4: What credit score do I need to get approved?

Most applicants with good credit (typically around 670 and higher) have the best chances of approval, but some with fair credit have also been approved.

Q5: Do Sephora Credit Card rewards and Beauty Insider points combine?

They’re separate, but you earn both when you shop. The card earns Reward Dollars, and you also earn Beauty Insider points for the same purchase.

Q6: Can I stack my 25% discount with other coupons or sales?

Usually, no. The 25% discount is a standalone offer and can’t be combined with most other promotions.

Conclusion

The Sephora Credit Card is designed for one kind of person: someone who genuinely loves Sephora and shops there often. It rewards loyalty with 4% back, doubles your Insider points, and gives you a solid first-purchase discount.

But it’s not a one-size-fits-all credit card. The short reward expiration period, limited usability, and high interest rate make it less appealing for casual shoppers or those who carry balances.

If Sephora is your beauty home base and you manage your credit responsibly, this card can be a nice bonus. If not, a general cash-back card may give you more flexibility and value over time.

Think of the Sephora Credit Card as a beauty-specific bonus tool—not your everyday financial workhorse.