Midas Credit Card Reviews 2026

Midas credit card is a financial tool that offers benefits such as a rewards program, low-interest rates, no annual fee, and global acceptance. Applying for the card is easy and can be done online by providing personal and financial information. Once approved, the card can be used at millions of locations worldwide. Cardholders can manage their account online and make payments through various methods. The Midas credit card is a convenient option for those looking to access credit with added benefits and rewards.

Midas Credit Card payment methods

Midas offers several payment methods for its credit card bills:

- Online: You can make a payment through the Midas website using a debit or credit card.

- AutoPay: You can set up automatic payments with a credit or debit card.

- Phone: You can make a payment by calling Midas customer service and paying with a debit or credit card.

- Mail: You can send a check or money order to the address listed on your billing

- In-Person: You can visit a Midas location to make a payment with cash, check, or credit/debit

It’s important to note that payment methods may vary depending on your location and the specific terms of your credit card agreement.

Read More: Harbor Freight Credit Card Review: A Comprehensive Guide

How to apply for the Midas Credit Card

To apply for a Midas Credit Card, you can follow these steps:

- Visit the Midas website: Go to the Midas website and look for the option to apply for a credit

- Fill out the application form: Provide the required personal and financial information, such as your name, address, income, and employment information.

- Apply: Review your information for accuracy and submit the

- Wait for approval: Midas will review your application and decide whether to approve or deny. If approved, you will receive your new credit card in the mail.

It’s important to carefully review the terms and conditions of the credit card agreement, including the interest rate, fees, and rewards program, before accepting the offer. You can also contact Midas customer service for more information or to ask any questions about the credit card.

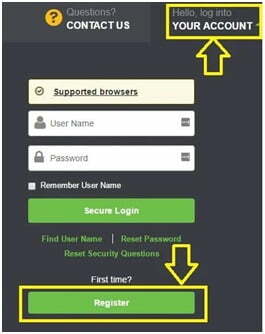

How to Retrieve Your Username or Password?

Reset or change your account information by the simple steps:

For Username

- Visit this recovery site

- Fill in your required information

- Click “Continue” after filling in

Midas synchrony card

The Midas Synchrony Card is a store credit card offered by Midas, a leading provider of automotive services, including brakes, mufflers, and exhaust systems. The card is issued by Synchrony Bank and can be used to make purchases at Midas locations.

With the Midas Synchrony Card, cardholders can take advantage of special financing offers, exclusive promotions, and discounts on Midas services and products. They can also manage their account online, view their account balance and transactions, and make payments.

It’s important to note that store credit cards like the Midas Synchrony Card may have a higher interest rate compared to traditional credit cards, and it’s recommended to pay the balance in full each month to avoid paying interest charges. Before applying, it’s important to carefully review the terms and conditions of the card, including the interest rate, fees, and rewards program, to ensure it meets your needs and financial situation.

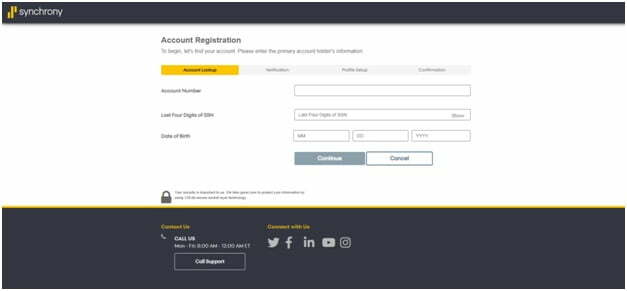

Midas Synchrony Card Login Process

Follow the steps below for registration:

- Select “I want to register” from the login page

- Provide your Account Number, the last 4 digits of your SSN, and your date of birth to verify

- Click “ Continue”

Midas Credit Card application

To apply for a Midas Credit Card, you can follow these steps:

- Visit the Midas website: Go to the Midas website and look for the option to apply for a credit

- Fill out the application form: Provide the required personal and financial information, such as your name, address, income, and employment information.

- Apply: Review your information for accuracy and submit the

- Wait for approval: Midas will review your application and decide whether to approve or deny.y If approved, you will receive your new credit card in the mail.

It’s important to carefully review the terms and conditions of the credit card agreement, including the interest rate, fees, and rewards program, before accepting the offer. You can also contact Midas customer service for more information or to ask any questions about the credit card.

Midas Credit Card requirement

The specific requirements to apply for a Midas Credit Card may vary, but typical, ly you will need to meet the following eligibility criteria:

- Age: You must be 18 years or older to apply for a Midas Credit Card.

- Residency: You must reside in the country where the card is

- Income: You should have a stable source of income to ensure that you can make the required monthly

- Credit history: A good to excellent credit history may increase your chances of getting approved for a Midas Credit Card.

It’s important to keep in mind that each credit card issuer has its own underwriting standards and may require additional information and documentation. The information required for a Midas Credit Card application can be found on the Midas website or by contacting Midas customer service.

Midas Credit Card payment option

Midas Credit Card offers several payment options to help you manage your account and make payments:

- Online payment: You can make payments online through the Midas website or the Synchrony Bank

- AutoPay: You can set up automatic monthly payments to ensure that you never miss a due

- Mail payment: You can send your payment by mail to the address listed on your billing

- Phone payment: You can make a payment by calling Midas customer service and providing your payment information over the

- In-store payment: You can make a payment at any Midas location.

It’s important to make your payments on time to avoid late fees and to keep your account in good standing. You can also view your payment history and account balance online or by calling Midas customer service.

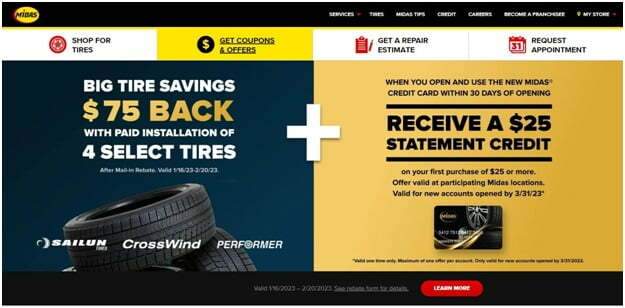

Midas Credit Card financing

Midas Credit Card offers financing options for customers who are purchasing a Midas location. These financing options typically include special promotions and exclusive discounts on automotive services, such as brakes, mufflers, and exhaust systems.

With the Midas Credit Card, you may be able to take advantage of promotional financing offers, such as no interest if paid in full within a certain number of months or reduced interest rates for a limited time. These offers can be a convenient way to pay for larger purchases, allowing you to spread the cost over a longer period.

It’s important to carefully review the terms and conditions of the financing offers, including the interest rate, fees, and repayment terms, to ensure that they meet your needs and financial situation. You can also contact Midas customer service for more information or to ask any questions about the financing options.

Pay Bill Online

With the Synchrony Financial online service, you may make one-time payments as well as set up automatic monthly payments. You can also manage your account and view the due date for your next payments.

Follow these steps to get started:

- Log in and then choose “Make Payment” on the options menu

- Enter the amount, date, and payment source you want

- After that, choose “Submit Payment for Review.”

- Review carefully before clicking “Submit.t”

Pay By Phone

You can also call 1-866-396-8254 to pay your Midas credit bills. Your call will be answered by an automated system or a bank representative who will guide you through the procedure.

Note: Please keep in mind that you’ll need to enter either your Social Security number or your account number.

Pay By Mail

Write a check with the appropriate information, including the account number, which you can easily find on your statement. It is advisable to send it five working days before the expiry date of the invoices so that payment is made on time.

You can send your payments to the following email address:

- Synchrony Bank

- O. Box 960061

- Orlando, FL 32896-0061

Customer Service

If you have any issues with your card, please get in touch with the credit card customer service by calling 1-866-419-4096, sending a secure email, or using the live chat feature.

Note: Please be aware that Synchrony Bank is unable to discuss or provide specific account information via unencrypted methods to preserve the privacy itsthe customers. Please give a representative at least 3 business days to respond to your inquiries.

Email: customer.service@mail.synchronybank.com

If you want to have more new experiences, we will provide you with useful services about arhaus credit card login. We will provide all the information in this post that is helpful for you

Pros and Cons of the Midas Credit Card

Pros of the Midas Credit Card:

- Convenient: The Midas Credit Card can make it easier to pay for automotive services and products, allowing you to spread the cost over a longer period of

- Special financing offers: The card may offer special financing promotions, such as no interest if paid in full within a certain number of months or reduced interest rates for a limited time.

- Rewards program: The card may offer a rewards program, allowing you to earn points or cash back for your purchases.

- Easy to use: The card can be used at any Midas location, and you can manage your account online or by calling customer service.

Cons ofthe Midas Credit Card:

- High-interest rates: The interest rates on the Midas Credit Card may be higher than those on other credit cards, making it more expensive to carry a

- Limited use: The card can only be used at Midas locations, so it may not be as flexible as other credit cards.

- Fees: The card may have annual fees, late fees, and other charges, so it’s important to carefully review the terms and conditions before accepting the offer.

- Credit impact: Applying for a Midas Credit Card may result in a hard inquiry on your credit report, which can temporarily lower your credit score.

It’s important to weigh the pros and cons of the Midas Credit Card and to carefully review the terms and conditions before accepting the offer. You can also compare the card to other credit cards to find the best option for your needs and financial situation.

FAQs

Here are answers to some frequently asked questions about the Midas credit card:

Q. What is the Midas credit card?

The Midas credit card is a financial product that provides access to credit for its users.

Q. What are the benefits of having a Midas credit card?

The benefits of having a Midas credit card can vary depending on the specific card and issuer, but may include things like rewards programs, cash back, points, sign-up bonuses, and more.

Q. How do I apply for a Midas credit card?

You can apply for a Midas credit card through the issuing bank’s website or by visiting a local branch. You’ll typically need to provide personal and financial information, including your income and employment information.

Q. What is the minimum credit score required to get a Midas credit card?

The minimum credit score required to get a Midas credit card can vary depending on the issuer, type of card, and other factors. Generally, it’s best to have a good or excellent credit score (680 or higher) to be eligible for the best credit card offers.

Q. What is the interest rate for a Midas credit card?

The interest rate for a Midas credit card can vary depending on the specific card and issuer, but is usually a variable rate based on the prime rate. The interest rate can also vary based on factors such as your credit score and payment history.

Q. Is there an annual fee for a Midas credit card?

Some Midas credit cards may have an annual fee, while others may not. It depends on the specific card and issuer.

Q. What should I do if my Midas credit card is lost or stolen?

If your Midas credit card is lost or stolen, you should report it immediately to the issuing bank to prevent unauthorized use. Most banks have 24/7 customer service lines for reporting lost or stolen cards.

Read More: Best EGG Credit Card Review

Conclusion

The Midas credit card is a financial product that provides access to credit and can offer various benefits such as rewards programs, cash back, points, sign-up bonuses, and more. Eligibility for a Midas credit card may depend on factors such as your credit score, income, and employment information. The interest rate and annual fee may vary depending on the card and issuer. If your Midas credit card is lost or stolen, it’s important to report it immediately to the issuing bank.