Shareholder Wealth in a Firm – Things you need to know 2026

Firm shareholders are individuals, organizations, or entities that own equity in a corporation. When a company is formed, it issues shares of stock that represent ownership in the company. These shares can be bought and sold on the stock market, and the individuals or entities that hold these shares are considered the company’s shareholders.

Rights and Responsibilities

Shareholders have several important rights and responsibilities within the company. As owners of the company, shareholders have the right to vote on major corporate decisions, such as the election of the board of directors, mergers and acquisitions, and changes to the company’s bylaws. Shareholders also have the right to receive a portion of the company’s profits in the form of dividends.

In addition to their rights, shareholders also have certain responsibilities within the company. Shareholders are responsible for electing the board of directors, which is responsible for overseeing the company’s management and making important decisions on behalf of the company. Shareholders also have a responsibility to hold the board and management accountable for their actions and to advocate for the best interests of the company.

Read More: Dhani One Freedom Card Review

Types of Shareholders

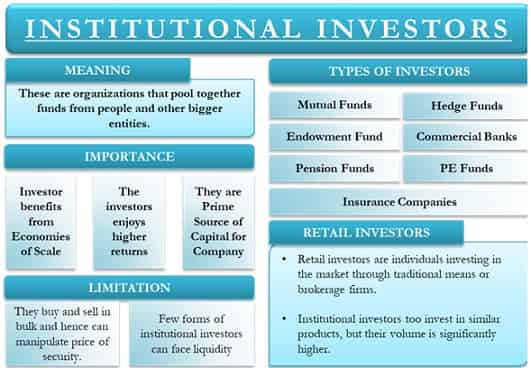

Shareholders can be divided into two main categories: institutional shareholders and individual shareholders.

Institutional shareholders are large organizations, such as pension funds, mutual funds, and hedge funds, that invest significant amounts of money in the stock market. These organizations often have a significant amount of voting power within the company and can use this power to influence the company’s decision-making process.

Individual shareholders, on the other hand, are individual investors who own relatively small amounts of stock in the company. While individual shareholders may not have as much voting power as institutional shareholders, they still have an important role to play in the company. Individual shareholders can attend shareholder meetings, ask questions of management, and vote on important corporate decisions.

Majority shareholders are individuals or entities that own more than 50% of a company’s outstanding shares of stock. They are often referred to as controlling shareholders because they can control the company’s decision-making process.

In most cases, the majority shareholders are the largest investors in a company and hold a significant amount of voting power. This gives them the ability to elect the board of directors, approve major corporate decisions, and make changes to the company’s bylaws. As a result, the majority shareholders have a significant impact on the direction and strategy of the company.

Overall, the majority shareholders play a critical role in the corporate landscape. They have significant control over the direction and strategy of the company and must act in the best interests of the company and its shareholders. While they may have significant power, they also have important responsibilities to ensure that minority shareholders are treated fairly and that the company is run responsibly and ethically.

Firm wealth refers to the value of a company’s assets that generate cash flow or revenue, which is often used to pay for expenses and investments in the business. It is a critical measure of a company’s financial health and its ability to grow and create value for its shareholders. A company’s wealth is typically measured by its net worth, which is calculated by subtracting its liabilities from its assets.

Factors that contribute to a company’s wealth

Several key factors contribute to a company’s wealth. One of the most important factors is the quality of the company’s assets. A company’s assets can include physical assets such as real estate, equipment, and inventory, as well as intangible assets such as intellectual property, brand recognition, and customer loyalty. These assets can generate revenue for the company and contribute to its overall wealth.

Another important factor that contributes to a company’s wealth is its ability to generate cash flow. Cash flow refers to the amount of money that a company generates from its operations after all expenses have been paid. Positive cash flow is critical for a company’s survival, as it allows the company to pay its bills, invest in new projects, and distribute dividends to its shareholders.

In addition, a company’s ability to grow and expand its operations is also an important factor in creating firm wealth. Growth can come in the form of expanding into new markets, developing new products or services, or acquiring other companies. By growing and expanding its operations, a company can increase its revenue, generate more cash flow, and create value for its shareholders.

Finally, a company’s relationship with its stakeholders, including customers, employees, and shareholders, can also impact its wealth. A strong relationship with customers can lead to increased sales and revenue, while a positive relationship with employees can lead to higher productivity and lower turnover. Similarly, a strong relationship with shareholders can lead to increased investment and higher stock prices, which can increase the company’s overall wealth.

Frequently Asked Questions

Q. What is shareholder wealth in a firm?

Shareholder wealth in a firm refers to the total value of a company’s assets and earnings that generate cash flow, which is then used to pay for expenses and investments in the business. It is a key measure of the company’s financial health and its ability to create value for its shareholders.

Q. How is shareholder wealth in a firm calculated?

Shareholder wealth is calculated by subtracting a company’s liabilities from its assets. This is known as the company’s net worth or equity. Shareholder wealth can also be calculated by looking at the company’s stock price and the number of outstanding shares.

Q. How can a company increase shareholder wealth?

A company can increase shareholder wealth by increasing its revenue and profits, generating positive cash flow, managing its assets effectively, and making strategic investments that will create long-term value. A strong relationship with customers, employees, and shareholders can also impact a company’s wealth.

Q. How does a company’s management impact shareholder wealth?

The decisions made by a company’s management team can have a significant impact on the company’s financial health and, consequently, its wealth. Management decisions regarding investments in new projects, cost-cutting measures, and pricing strategies can impact the company’s cash flow and overall profitability.

Q. How does a company’s relationship with shareholders impact shareholder wealth?

A strong relationship with shareholders can lead to increased investment and higher stock prices, which can increase the company’s overall wealth. Companies can improve their relationship with shareholders by being transparent and communicating effectively with them.

Q. How can a company protect minority shareholders while still benefiting majority shareholders?

Majority shareholders have a fiduciary duty to act in the best interests of the company and its shareholders as a whole, rather than just their own interests. They must make decisions that will benefit the company in the long term, even if they may not benefit them in the short term. In addition, majority shareholders must ensure that minority shareholders are treated fairly and have their rights protected.

Conclusion

Shareholder wealth in a firm is a key measure of the financial health and success of a company. Majority shareholders, who control a significant portion of a company’s shares, can impact the company’s direction and strategy and must act in the best interests of the company and all of its shareholders. While the primary responsibility of the majority shareholders is to act in the best interests of the company, they must also ensure that minority shareholders are treated fairly and their rights are protected.

A company’s ability to increase shareholder wealth depends on a variety of factors, including revenue and profits, cash flow, strategic investments, and effective management decisions. A strong relationship with shareholders, including effective communication and transparency, can also play a critical role in the long-term success and wealth of a company.