Stashfin Card

StashFin is a digital lending platform that offers a range of financial products and services to customers in India. One of their key offerings is the StashFin card, a credit card designed to provide users with easy access to credit, and a host of benefits and features.

The StashFin card is a Visa-powered credit card that can be used to make purchases at millions of merchants around the world. It offers users a credit limit that can be used to make purchases, pay bills, or withdraw cash from ATMs. One of the key benefits of the StashFin card is its digital-first approach, which makes it quick and easy to apply for, activate, and use.

Features and benefits, including:

- No annual fee: The StashFin card does not charge an annual fee, which can save users a significant amount of money over time.

- Cashback rewards: Users can earn cashback rewards on their StashFin card purchases, which can be redeemed for a range of products and services.

- The amount available as Credit: The amount of credit available for the customers under the StashFin Line of Credit can be as low as Rs. 500 up to a maximum of Rs. 5, 00,000.

- Tenure for Credit: The tenure of the credit is flexible and can be up to the discretion of the customer. The tenure of the line of credit can be from a period of 3 months up to a maximum of 36 months or 3 years.

- Interest Rate: The rate of interest for the line of credit format is charged on the amount that is withdrawn from the total limit allowed to the customer. StashFin charges interest at the rate starting from 11.99% on the amount withdrawn from the total credit allowed. The final rate of interest will vary on case to case basis and will depend on the credit profile of the applicant, the amount of credit sought, and the tenure of the credit.

- Instant Disbursal: StashFin provides instant disbursal of the credit upon approval. The customer will get the disbursal of the credit limit within 4 hours of approval when applied through the website. The disbursal is instant, i.e. within 90 seconds, in case the customer applies for the line of credit through the mobile application.

- Overall, the StashFin card is a useful tool for users who need access to credit, and want a quick and easy way to apply for and use a credit card. With its digital-first approach and range of features and benefits, the StashFin card is well-suited to the needs of modern consumers in India.

If you’re considering getting a StashFin card, there are a few things you should know:

- Eligibility criteria: To be eligible for a StashFin card, you must be an Indian citizen or resident, be at least 18 years old, have a stable source of income, and have a good credit score.

- Digital application process: The StashFin card application process is entirely digital, which means you can apply for the card from the comfort of your home or office. You’ll need to provide some basic information and documents to complete the application process.

- Instant credit: The StashFin card offers instant credit, which means you can use your credit limit right away to make purchases, pay bills, or withdraw cash from ATMs.

- No annual fee: The StashFin card does not charge an annual fee, which can save you money over time.

- Cashback rewards: With the StashFin card, you can earn cashback rewards on your purchases, which can be redeemed for a range of products and services.

- Flexible repayment: The StashFin card offers flexible repayment options, allowing you to pay back your balance over a longer period.

- Late payment charges: If you don’t make your credit card payments on time, you’ll be charged a late payment fee. Make sure to pay your bills on time to avoid additional charges.

- Interest charges: The StashFin card charges interest on your outstanding balance, so it’s important to pay your bills on time to avoid accumulating interest charges.

- Security features: The StashFin card uses advanced security features to protect you against fraud and unauthorized transactions. Make sure to keep your card and personal information secure to avoid any fraudulent activity.

Overall, the StashFin card is a useful financial tool that can help you manage your expenses and build your credit score. Make sure to read the terms and conditions carefully before applying for the card, and use it responsibly to avoid any additional charges or fees.

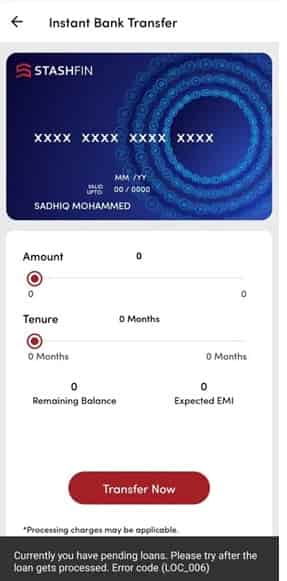

How to transfer money from a Stashfin card to a Bank account

To transfer money from your StashFin card to a bank account, you can follow these steps:

- Log in to your StashFin account on the mobile app or website.

- Click on the “Transfer” or “Payment” option in the app or website menu.

- Select the option to transfer funds to a bank account.

- Enter the amount you want to transfer and select the bank account you want to transfer the funds to.

- Confirm the details and initiate the transfer.

It’s important to note that there may be some charges associated with transferring funds from your StashFin card to a bank account. These charges will depend on the specific terms and conditions of your card. It’s always a good idea to review the terms and conditions carefully before making any transfers or payments.

Stashfin Credit Line Card Eligibility

To be eligible for a StashFin credit line card, you must meet the following criteria:

- You must be an Indian citizen or resident.

- You must be at least 18 years of age.

- You must have a stable source of income.

- You must have a good credit score.

- You must provide the necessary documents such as ID proof, address proof, and income proof.

The eligibility criteria may vary depending on the specific terms and conditions of the StashFin credit line card. To determine your eligibility and apply for the card, you can visit the StashFin website or download the mobile app and follow the application process. Once your application is submitted, the StashFin team will review your application and determine your eligibility based on the criteria mentioned above. If you’re approved, you’ll be able to access the credit line and start using it to make purchases, pay bills, or withdraw cash from ATMs.

Stashfin partner login process

If you are a partner with StashFin and would like to log in to your account, you can follow these steps:

- Go to the StashFin website and click on the “Partner Login” button located at the top right corner of the page.

- Enter your registered mobile number and password in the respective fields.

- Once you have entered your login credentials, click on the “Log in” button.

- If your login details are correct, you will be taken to your partner account dashboard.

If you have forgotten your password, you can click on the “Forgot Password” link on the login page and follow the prompts to reset your password.

If you are having trouble logging in or accessing your partner account, you can contact StashFin’s customer support team for assistance. They will be able to help you with any login or account-related issues you may be experiencing.

How to apply for a Stashfin credit card online

To apply for a StashFin credit card online, you can follow these steps:

- Go to the StashFin website and click on the “Credit Cards” option from the top menu.

- Select the credit card you are interested in and click on the “Apply Now” button.

- Fill out the online application form with your details, contact information, and income details.

- Upload the required documents, including ID proof, address proof, and income proof.

- Review and submit your application.

- Once your application is submitted, the StashFin team will review your application and determine your eligibility for the credit card.

- If you are approved, you will receive your credit card in the mail, along with your credit limit and other card details.

It’s important to note that the exact process for applying for a StashFin credit card may vary depending on the specific card you are interested in and the terms and conditions of the card. Make sure to carefully review the eligibility criteria and other details before submitting your application. If you have any questions or concerns, you can contact StashFin’s customer support team for assistance.

Stashfin Sentinel

StashFin Sentinel is a security feature offered by StashFin that helps protect customers’ financial and personal information from fraud and unauthorized access. The feature provides real-time alerts and notifications to customers in case of any suspicious activity or potential security breaches.

What is a Stashfin card on amazon?

StashFin card in Amazon is a co-branded credit card offered by StashFin in partnership with Amazon. The card is designed to offer customers a range of rewards and benefits for using the card to make purchases on Amazon, as well as for other everyday purchases.

Some of the benefits of the StashFin card on Amazon include cashback rewards on Amazon purchases, as well as other rewards and discounts on fuel, dining, and entertainment purchases. The card also offers a range of other features and benefits, such as no annual fee, flexible repayment options, and instant EMI options for large purchases.

To apply for the StashFin card on Amazon, customers can visit the Amazon website and follow the application process. Once approved, customers can start using the card to make purchases and earn rewards and benefits. It’s important to note that the exact terms and conditions of the StashFin card in Amazon may vary depending on the specific card and the offers available at the time of application.

How to generate Stashfin credit card pin

To generate a PIN for your StashFin credit card, you can follow these steps:

- Log in to your StashFin account on the StashFin website or mobile app.

- Navigate to the “Credit Card” section of your account dashboard.

- Click on the “Generate PIN” option.

- You will be asked to enter your card details and some personal information to verify your identity.

- Once you have completed the verification process, you will be prompted to create a new PIN for your credit card.

- Enter a new 4-digit PIN and confirm the same.

- Your new PIN will be saved and you can start using it to make purchases and transactions with your StashFin credit card.

It’s important to keep your PIN safe and secure to protect against unauthorized access to your credit card account. If you ever need to change your PIN, you can follow these same steps to generate a new one through your StashFin account.

FAQs – StashFin Line of Credit

What is a line of credit?

A line of credit is a form of a continuous loan of a fixed limit provided by the lender. The customer can use or withdraw the amount up to the credit limit allowed and pay interest only on such an amount and not on the entire limit. Such credit limit although offered for a short term and at easily affordable interest rates, the customer gets the benefit of a continuous or revolving credit or renewal of the credit limit after the payment of dues on each due date.

What is the maximum credit allowed under the StashFin Line of Credit?

Customers get credit up to Rs. 5, 00,000 under the StashFin Line of Credit.

What is the rate of interest charged by StashFin?

StashFin charges interest starting from 11.99% per annum for its line of credit. The final interest rate will vary from case to case.

Can a person use the StashFin Card to withdraw money from an ATM?

Yes. A StashFin Card can be used to withdraw cash from an ATM. The company provides 10 such free withdrawals post which it will charge the customer Rs. 20 per withdrawal.

What is the tenure of the StashFin Line of Credit?

Customers get a minimum of 3 months and a maximum of 3 years as tenure under the StashFin Line of Credit.

How can I contact StashFin customer support?

A: You can contact StashFin customer support by phone, email, or live chat through the StashFin website or mobile app.

Conclusion

StashFin is a digital lending platform that offers a variety of financial products and services, including personal loans, credit cards, and insurance. StashFin provides a fast and easy application process, competitive interest rates, flexible repayment options, and other benefits. StashFin also uses advanced security measures to protect customer data and prevent fraud and offers a range of features and tools such as the StashFin Sentinel to help customers monitor their accounts and protect against potential security threats. Whether you’re looking for a loan or a credit card, StashFin can be a great option for those who want a convenient and reliable financial solution.

Faizan Ahmad is a financial analyst and writer who specializes in investments, banking, and corporate finance. He has over 7 years of experience working in the finance industry in various roles.

He leverages his strong financial modeling and data analysis skills to provide insightful commentary on business, markets, and economic trends.

At Ventures Money, Faizan covers topics including Credit Card Reviews, Loans, Insurance, and Mutual Funds in the banking sector. He provides in-depth analysis of the latest news and trends to help readers make smart investment decisions.

Outside of writing, Faizan enjoys following the stock market, rooting for his favorite sports teams, and spending time with his family.