The idea of Makwa Finance was first proposed by economist Lysander Spooner in the early 1900s. He proposed utilizing micro-loans to aid financially struggling farmers and small business owners.

If you need cash immediately, Makwa Loans can help. A short response time for Makwa Loans lenders is often the next business day, however, this might be as little as 24 hours depending on the lender you pick.

The debt financing alternatives offered by Makwa Finance include term loans, credit lines, and other types of debt financing. The firm makes equity investments in a variety of sectors, including IT, healthcare, and real estate. Makwa Finance offers advice on a broad variety of financial issues, from mergers and acquisitions to strategic planning. The company’s main goal is to help businesses reach their financial potential via a range of innovative financing alternatives, individualized support, and professional guidance.

To log in to an online account with a financial services company, you will need to do the following:

- Find the login page on the company’s website. You can find this page at the top right of the website or in the main menu.

- Once you have entered your login information, click the “login” button.

- In the spaces provided, type your username or email address and your password. If you can’t remember your password, you can usually find a link to reset it.

- If your login information is correct, you will be taken to your account dashboard, where you can view your account information, make payments, and manage your account.

Make sure you are logging in to the official Makwa Finance website and using a secure connection when you enter your login information. If you are having trouble logging in, you can call Makwa Finance’s customer service for help.

Does Makwa Finance report to credit bureaus?

Makwa Finance is a provider of financial services to companies, and as such, it could submit credit bureau reports. The kind of financing offered and the conditions of the financing arrangement will determine whether Makwa Finance reports to credit agencies or not, among other things.

In general, a firm will probably notify credit bureaus if it has obtained a loan or a line of credit from Makwa Finance. This is so that credit bureaus, which utilize the repayment history of their clients to determine credit scores and credit reports, can compute them. The majority of lenders do this.

Businesses might gain from reporting to credit bureaus since it can help them establish credit and raise their credit ratings over time. To prevent any harm to credit ratings, it’s crucial to complete all payments on schedule and in full.

It is advised to get in touch with Makwa Finance directly or speak with a financial adviser if you have particular queries regarding whether Makwa Finance submits information to credit agencies or how their financing options may affect your credit.

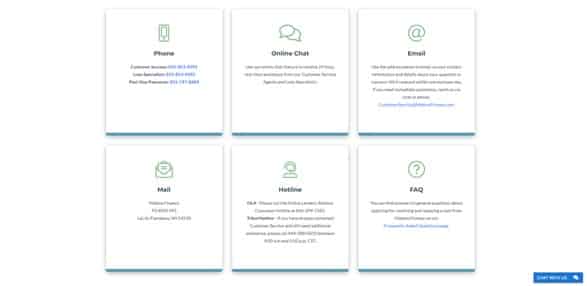

Makwa Finance customer service

If you need assistance with an application, have questions about your account, or would like help paying off your loan early, professional Customer Success Agents and Loan Specialists are available 24 hours a day.

- For customer success, call 855-853-4392.

- For past-due payments, call Loan Specialists at 855-747-8684 or 855-853-4392.

- Message boards:

- Use our online chat feature to communicate with our customer care agents and loan experts in real-time, around-the-clock.

Mailing address:

- Lac du Flambeau

- WI 54538 Makwa Finance

- PO Box 343

Makwa Finance personal loan

If you own a small or medium-sized business, you should look into the financing options offered by Makwa Finance. The firm did not provide consumer loans or services at that time.

Business owners in a wide range of sectors may turn to Makwa Finance for asset-based lending, working capital finance, and equipment financing. All of the company’s financing options are geared toward giving companies a hand up when they need it most so that they may continue to thrive and even expand.

There are many alternative banks and financial institutions to choose from if you’re looking for a personal loan or consumer lender. Research your alternatives and compare interest rates, payback periods, and other aspects to discover the personal loan that best suits your requirements before committing to one.

Makwa Finance application

You can fill out an online application on Makwa Finance’s website if you want to get a loan from the company. Here are the main steps you can take to get a loan from Makwa Finance:

- Go to the website for Makwa Finance: Go to the website of Makwa Finance and find the “Apply” section.

- Please fill out the form: Fill out the online application form, which usually asks for information about your business, such as its name, industry, and income.

- Provide proof: Depending on the type of loan you’re trying to get, you may need to provide more proof, like financial statements, tax returns, or invoices.

- Submit your application: Once you’ve filled out the application and sent in any supporting documents, you can send it in for review.

- Wait for a decision. Makwa Finance’s underwriting team will look at your application and supporting documents to decide if you are eligible for financing.

If you are approved for financing, Makwa Finance will give you the loan or financing agreement. This will tell you the terms and conditions of the loan, such as the interest rate, how long you have to pay it back, and if there are any fees or penalties.

Before taking out a loan, it’s important to carefully read over the terms of the agreement. Make sure you know how to pay back the loan and can do so on time and in full. You can ask Makwa Finance’s customer service team for help if you have any questions or concerns about the application process.

Where is Makwa Finance located?

The physical location of Makwa Finance was not shown on their website or other online sources. On its website, however, the company gave a phone number and an email address for loan applications and questions about customer service.

However PO BOX 241 (From 241 to 360), LAC DU FLAMBEAU, WI 54538-0241, USA

FAQs

What is an installment loan?

A short-term installment loan is a loan that is repaid with a fixed number of payments made at regular intervals until the balance is paid off. You can pay off the loan early with no pre-payment penalties at any point during the repayment schedule. Short-term installment loans are typically non-secured, meaning that you do not put up a form of collateral that would be surrendered if you defaulted on the loan.

What are the differences between payday loans and short-term installment loans?

The two major differences between payday loans and short-term installment loans are the number of payments and lengths of the repayment terms. Payday loans are typically repaid with a single payment, due when the borrower receives their next paycheck. Short-term installment loans are repaid in multiple fixed payments, made over months.

Because the repayment term on a payday loan is so short, many borrowers fail to repay their loans on time. A payday loan can then be “rolled over” into a new loan with additional fees and interest, pushing the borrower into a potential “debt cycle.”

What are the minimum qualifications?

It’s part of Makwa Finance’s mission to provide accessible, transparent funding. If you meet the minimum requirements listed below, it’s more than likely we’ll be able to provide the funding you need.

- Receive regular income

- Are at least 18 years old and a U.S. citizen

- Have an active checking account

- Are not actively serving in the military or a dependent of someone actively serving in the military?

* Other requirements may apply.

Can I get a loan if I have bad credit or credit history?

Makwa Finance can help borrowers with a range of credit ratings, including those with less-than-perfect credit. As long as you meet the requirements listed above, we will more than likely be able to extend your funding.

How much money I can borrow?

Qualified first-time customers can borrow up to $1,500. Qualified repeat customers can borrow up to $2,500.

How do I repay my loan?

Your loan agreement will include a payment schedule detailing payment amounts and due dates. You are strongly encouraged to pay off your loan as quickly as possible, as Makwa Finance does not charge any early pay-off penalties or fees, and it will reduce the overall cost of your loan. Please call a Customer Success Agent for assistance with early pay-offs: 855-853-4392.

For your convenience, you can have your payments withdrawn directly from your bank account. You can also send a cashier’s check or money order to Makwa Finance, PO BOX 343, Lac du Flambeau, WI 54538.

Contact Customer Success Agents at 855-853-4392 if you have questions about your payments.

What if I might be late with a payment?

If you might be late with a scheduled payment, please contact us as soon as possible to request a three-day courtesy extension. There is no additional fee for this extension, but it is only available once during the life of your loan.

How do I get a copy of my loan documents?

You can access your loan documents online at any time during the life of your loan by logging in to your account with your username and password. Once you’re on your account page, select “Loan Account.” On the Loan Overview page, select the “Download Loan Document” link.

If you have any difficulty accessing your documents, you can speak with a Customer Success Agent at 855-853-4392. They can help walk you through the process, or they can email the documents to you.

What if I need to cancel my loan?

To exercise your Right to cancel, you have until 3:00 p.m. CST the second business day after your “Disbursement Date” to begin the process of returning the funds interest-free. Keep in mind that your Disbursement Date is the date funds were transferred to your financial institution. This may not be the same date your bank makes those funds available to you, so please call 855-853-4392 as soon as possible if you want to cancel your loan. If you miss the Right to cancel deadline, you can still pay off your loan early without penalties and pay only the interest you’ve accrued up to your pay-off date.

Conclusion

To sum up, Makwa Finance is an internet lender that provides funding for small and medium-sized enterprises across several sectors. The firm provides asset-based loans, working capital finance, and equipment financing to companies to help them manage their cash flow and expand. Businesses may submit an online application for funding by visiting the Makwa Finance website.

Typically, they will be required to provide information about their company and supporting paperwork. The Makwa Finance customer support staff is available to assist clients with any queries or worries they may have about their financing alternatives. The precise location of Makwa Finance remained unknown to the general public as of September 2021. However, the firm could be active in several states and provide financing options to companies nationwide.