Famous Footwear Credit Card Review 2026

If you’re someone who buys shoes often (or wants to), the Famous Footwear® credit card, known as the FAMOUSLY YOU REWARDS® card, might catch your eye. It offers perks, rewards, and exclusive deals tied to shoe shopping. But like any store-branded card, it comes with trade-offs: high interest rates, limited utility outside the brand, and stricter terms. In this review, I’ll walk you through how the card works, its pros and cons, eligibility, tips to get more value out of it, and whether it makes sense for you.

Disclaimer: I’m not a financial advisor. This article is for informational purposes only. Before applying for any credit card, always check the latest terms, interest rates, and disclosures directly from the issuer (in this case, Famous Footwear or its card partner).

What Is the Famous Footwear Credit Card (FAMOUSLY YOU REWARDS®)?

The Famous Footwear credit card is a co-branded, store-based reward card. Its primary aim is to give extra benefits when you shop at the Famous Footwear app (in their stores, online, or via their app).

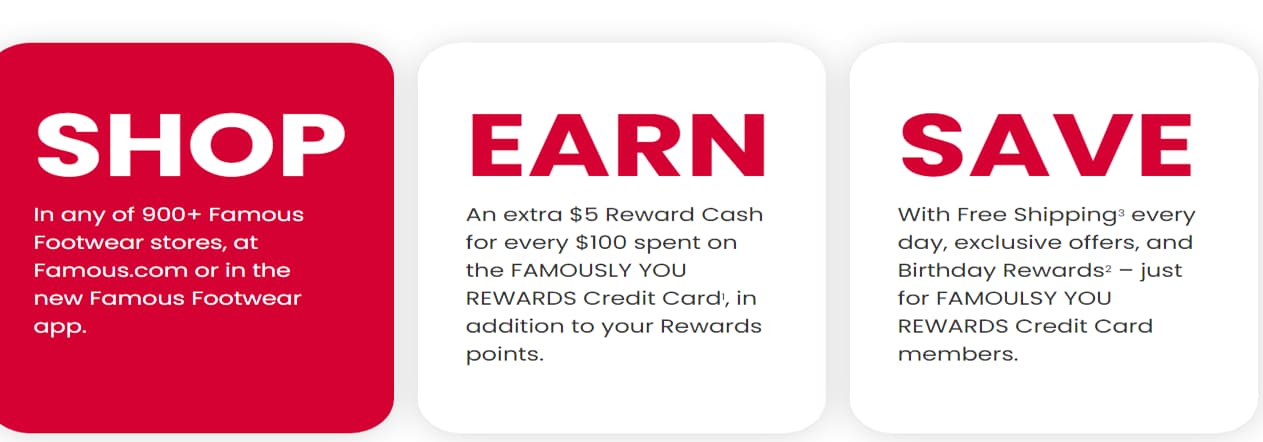

When you become a FAMOUSLY YOU REWARDS® cardholder, you still participate in the general Famously YOU Rewards program. On top of that, using the credit card gives you an onus “cardmember reward cash.

One common incentive is that when you open and use the card, you get $10 off your first purchase (subject to terms).

The card is issued via Comenity Bank (or a similar card issuer) under the Famous Footwear brand.

How Its Rewards & Benefits Work

Earning Points and Reward Cash

Here’s the typical flow:

- You earn 1 point per $1 spent using the credit card (on all purchases).

- As a member of the standard Famously YOU Rewards program, you also earn points (even if not use the credit card).

- When your points convert, 100 points = $5 Reward Cash.

- That $5 Reward Cash can be used at Famous Footwear stores or online, effectively like a discount toward your next purchase.

So, combining the credit card’s point earnings with the base rewards program lets you get “double value” (sort of).

Tiers and Extras: STAR vs SUPERSTAR

Famous Footwear has different tiers in its rewards system. At a higher tier (SUPERSTAR), you unlock extra perks.

- STAR is the default tier.

- If you spend a certain threshold (for example, $200 in 12 months, based on some sources), you can upgrade to SUPERSTAR status.

- SUPERSTAR members often get 1.5 points per $1 (instead of just 1) for card purchases.

- Also, they may receive things like free shipping (no minimum) and birthday bonus Reward Cash.

Other Perks

- Free Shipping (no minimum) for orders placed by cardmembers (or at higher tiers).

- Birthday reward: During your birthday month, you may earn 2x points per dollar on purchases.

- Exclusive deals and coupons: Cardmembers often get access to special offers, flash sales, or extra coupon stacking.

These perks are nice if you shop regularly with Famous Footwear.

Costs, APRs, and Fees

This part is where many store cards become less attractive for the occasional shopper.

Annual Fee

The Famous Footwear credit card has no annual fee. That’s a plus.

APR / Interest Rate

This is where caution is needed:

- The card uses a variable APR that can be quite high (some reviews state ~35.24%).

- If you carry a balance beyond the grace period, interest costs can erode any reward advantage.

- As of now, there’s no known introductory 0% APR promotion for purchases or balance transfers.

Balance Transfer, Cash Advances, Penalties

- Balance transfers are likely not permitted (common for store cards).

- Cash advances are also often disallowed or come with steep fees/interest.

- Late payment and penalty interest rates may apply if you miss due dates. (As with any credit card, that’s standard.)

- Foreign transaction fees: It’s unclear, but most store cards are limited to domestic purchases or may charge a fee for international use.

Who Is Eligible / What Credit Score Is Needed?

Because this is a store-branded credit card, it tends to have more lenient credit requirements than premium travel cards. Some sources suggest:

- A fair to good credit score (e.g, ~600 or above) might suffice.

- If you’re already a frequent Famous Footwear customer, that might help your case.

Approval also depends on income, existing debt, credit utilization, and other standard credit card criteria.

Real User Feedback & Issues

It’s not enough to see the polished benefits — always check how users experience the card and the brand.

Complaints & Negative Reviews

- On ConsumerAffairs, there are complaints about billing errors, delayed credits, and poor customer service.

- On Trustpilot, many reviewers accuse Famous Footwear of shipment failures, order cancellations without notice, and refund delays.

- Some Reddit users feel pressured or misled into applying for the credit card when shopping. > “Only $10 in rewards for opening a credit card … they have to socially engineer people into opening.”

- Some say the app can misbehave (bugs, account errors) when managing rewards or placing orders.

So the issues are not necessarily with the card mechanics, but with execution: fulfillment, customer support, consistency.

Positive Notes

- Some users enjoy that the rewards do stack and that free shipping is a real benefit, especially for people who shop often.

- The card may work well for those who always shop at Famous Footwear anyway and would benefit from incremental discounts just for loyalty.

Pros and Cons

| Pros | Cons |

|---|---|

| No annual fee | Very high APR if carrying a balance |

| $10 off your first purchase | Rewards are mostly only useful at Famous Footwear |

| Free shipping (often) | Limited flexibility outside the brand |

| Birthday bonus, exclusive offers | Possible customer service or fulfillment issues |

| Tiered rewards (STAR / SUPERSTAR) | No balance transfer or cash advance options |

If you buy shoes regularly from Famous Footwear, these perks can add up. But if you’re an occasional shopper or carry balances, it might be less beneficial.

How to Maximize Value

If you decide to apply, here are strategies to squeeze the most out of the card:

Pay the balance in full every month: Otherwise, the high interest will wipe out your rewards.

Shop during bonus point or coupon days: Combine extra point offers or BOGO deals with your card rewards.

Keep an eye on your tier status (STAR → SUPERSTAR): If you reach SUPERSTAR, the extra perks (like 1.5x points, free shipping) increase value.

Use the $10 new card bonus wisely: Make your first purchase count — don’t waste it on something trivial.

Redeem Reward Cash smartly.: Use it on full-price or higher value shoes so your discount has more impact.

Be cautious with the app order. Double-check: details before submitting, since users report that changes or cancellations can be tricky.

Track your credit utilization. If your card balance is significant relative to your credit limit, it could hurt your credit score.

Is It Worth It for You?

Here’s how to decide:

- You shop for shoes often from Famous Footwear → Probably yes. The rewards, free shipping, and bonus perks can justify the card.

- You buy shoes elsewhere or rarely → Probably no. The restricted reward utility and high APR make it less attractive.

- You carry credit card balances often → Skip it. The interest will outweigh the benefits.

- You already have good to excellent credit and want flexibility → A cash back or travel rewards card might be more versatile.

Use this litmus test: if you expect to generate more in Reward Cash discounts and perks than you might lose to interest or limitations, it can pay off.

FAQ

Q: Can I use the Famous Footwear credit card anywhere, or only at Famous Footwear?

A: You can use it anywhere the card is accepted (typically where the card network allows). But the most valuable points/perks) comes when you use it at Famous Footwear.

Q: Does the card have a 0% intro APR period?

A: Currently, there’s no publicly available 0% introductory APR offer for purchases or balance transfers.

Q: When do my points convert into Reward Cash?

A: After you accumulate enough points (e.g., 100 points), you can convert them into $5 Reward Cash, which can be used in future Famous Footwear purchases.

Q: What happens if I cancel the card but still have unused Reward Cash?

A: Usually, if you close the account, you may forfeit unused rewards. Always redeem before canceling.

Q: Is there a minimum spend to qualify for the UPERSTAR tier?

A: Yes. Some sources say spending $200 in a 12-month window is needed to reach SUPERSTAR status. But verify the latest terms on the official site.

Q: How do I pay my Famous Footwear credit card bill?

A: You can pay online (via the card issuer’s portal), by mail, or by phone. Check the official card website for payment methods and instructions.

Conclusion

The Famous Footwear credit card is a niche card designed to reward loyal shoe shoppers. If you frequently buy shoes from Famous Footwear, the perks (free shipping, bonus points, exclusive discounts) give real upside. But it’s not for everyone. The high interest rate and limited versatility make it risky if you don’t pay your balance each month.